Jump to a Specific Section

What is a Franchise?

For many people, being a franchise owner is an entrepreneur’s dream come true.

You get to run your own business, without the risk associated with starting from scratch and having to learn each facet of business ownership and operation the hard way (and there are many more facets than most entrepreneurs can imagine).

Franchise businesses provide prospective buyers with proven systems for management, training, operations, advertising and marketing, and vendor contacts.

Sure, it still requires planning, budgeting, day-to-day responsibilities, and proper personnel and customer management skills, but franchised brands already have an established customer base, protected territories and demographic data, so when you buy a franchise business, you can be fairly certain that there is a demand for that product or service.

Franchises often have special accounting needs and in some respects, can’t be treated the same as other businesses.

What Special Accounting Needs Do Franchises Have?

One unique accounting need that franchises have is specific Revenue reporting requirements.

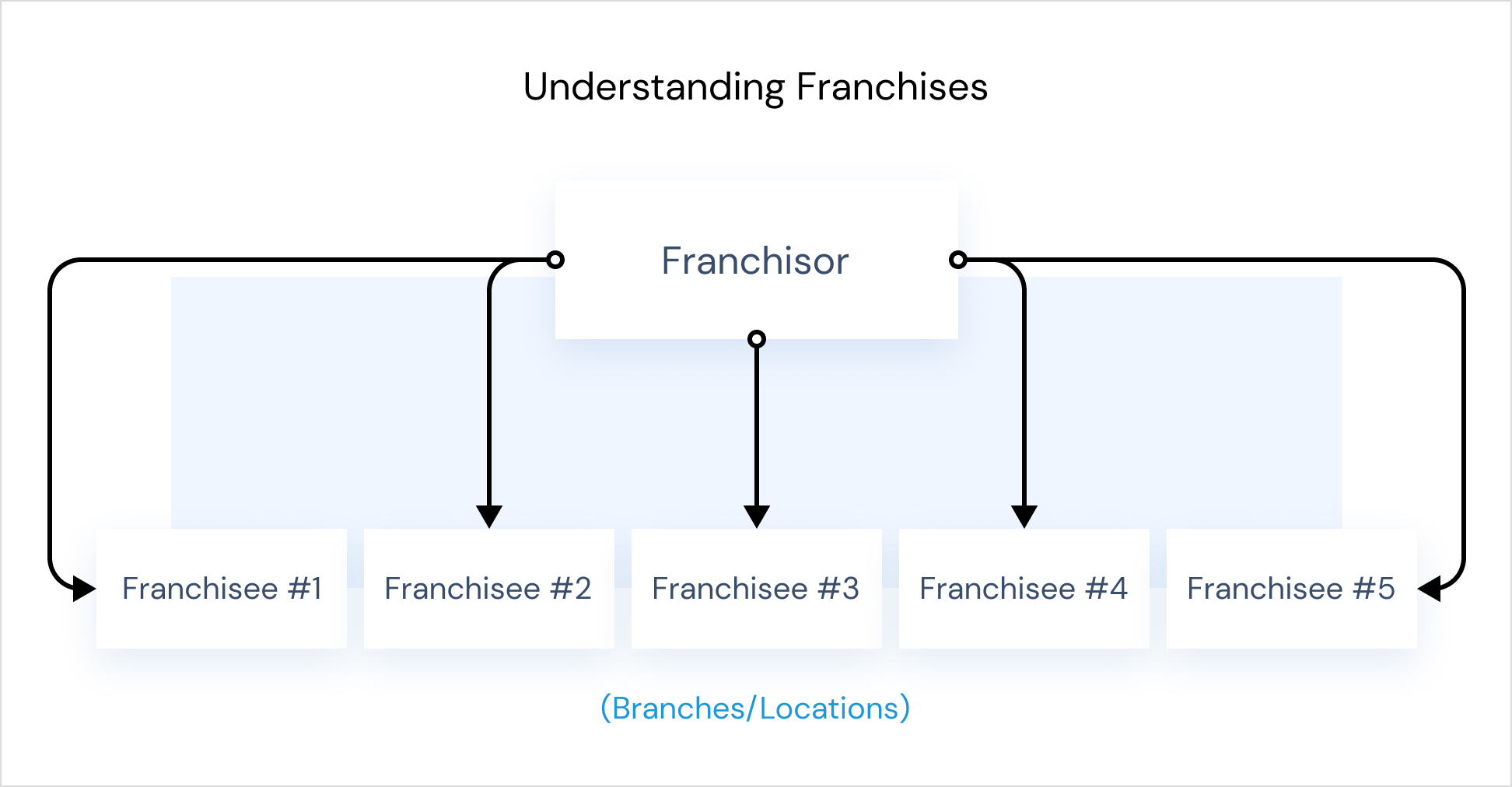

In a franchise system, there is a Franchisor and a Franchisee.

What is a franchisor?

The Franchisor is the person or company that owns the rights, trademarks, and licenses to a brand, product, or business.

They alone can grant a third party (the Franchisee) a license to conduct business using their proprietary products, services, and/or branding.

They own many aspects of the rights regarding the franchise locations and manage the big picture of the brand, but they rely upon individual owners to operate and grow each location.

What is a Franchisee?

The ‘Franchisee’ is a person or company that holds a license for the use of the Franchisor’s trademark, advertising, and any other proprietary property the Franchisor grants right-of-use to with the license in his endeavor to conduct business as permitted by the Franchisor.

The license most often includes a protected territory that cannot be encroached upon by another franchisee.

For that privilege, The Franchisee pays the Franchisor a franchise fee or ‘Royalty’, and typically, advertising fees as well.

There are certain guidelines sets by the Franchisor that franchisees must follow. Also, there are special assessments or discounts granted that may add or subtract from top-line sales, and materially affect Gross Sales on the Profit and Loss Statement.

These need to be captured and reported properly, for franchise compliance reasons as well as IRS compliance, but also to accurately reflect Sales and Expense data for evaluation purposes.

But those are P&L issues. Regarding the Balance Sheet, when purchasing a business, Initial Investment, loans and other assets and liabilities need to be listed and categorized properly if the new owner is to make full use of these items as year-end tax deductions.

Tangible and Intangible Assets, for example, are both deductible over a period of time to lessen the tax burden on the business.

Failing to capture these and other costs, or incorrectly placing them on the Profit and Loss Statement (an all-too-common mistake) can create myriad problems and inaccurate results when generating year-end tax returns, or analyzing the business to improve sales, procuring funds from a lender, or value the business for the purpose of selling or taking on an investor/partner.

Are there Start-up Fees for Franchises?

When a franchisee decides to purchase a franchise, he or she typically pays the franchisor an initial fee.

This can range from a basic license fee for use of the name, to include training, equipment, location scouting, opening assistance, signage, all the way to a full-blown “turn-key” package in which the franchisee returns home from the franchisor’s training center to a completely outfitted build-out, and begins operating immediately.

The cost of a franchise start-up fee depends on the specific business.

For example, an individual can purchase a food franchise for as low as $5,000 – $10,000. Subway restaurants require a Net Worth of only $30,000 and initial investment of $80,000.

On the other end of the scale, to open a Taco Bell or McDonald’s restaurant, you must have at least $750,000 in liquid assets and a Net Worth North of $2 Million. Other food restaurants like Wendy’s require an investor to have a minimum net worth of $5 million.

If you are interested in becoming a franchisee, you should to meet with a franchise accountant familiar with franchises and their requirements, first to determine your own personal net worth and liquid assets before choosing a business.

An accountant or accounting consultant who has experience with franchise systems and contracts can also assist in avoiding costly mistakes, as well as helping to obtain necessary financing for start-ups or to purchase a resale (a term franchisors use to describe an existing location).

These can be an excellent alternative to starting your own for many reasons, and although typically priced higher than a startup, an accounting firm familiar with franchise business acquisition and resale can show you how this option can actually be a much the more affordable alternative

What is the difference between franchise fees and royalties?

Once a franchisee begins doing business, he or she must pay the franchisor a portion of the revenue.

These are the Royalty fees.

It helps cover the franchisor’s operating costs. Royalty payments are usually made on a weekly basis, although depending upon the franchisor, payment intervals may vary to monthly or some other scheduled payment.

Now, many franchisors don’t need a franchisee to send them a check.

It is common in a franchise agreement for the franchisor to have permission to have direct access to a franchisee’s checking account and make ACH withdrawals. Regular franchise fees can also cover services, such as training or legal advice needed throughout the year.

The importance of using a qualified franchise accountant

Being a franchisee requires an individual to control the risks while making the most of the advantages of the business.

A franchisee needs strategies for hiring, then managing employees, staying on top of cash flow, dealing with debt, and reviewing and understanding the Key Performance Indicators for that business regularly, and making the proper adjustments to keep the business performing efficiently.

Franchise debt can start as soon as a franchisee pays the startup fee for joining the franchise network.

Bank or SBA loans to purchase the business, Lines of Credit to provide Operating Capital or Inventory, or Owner Financing, if the new franchisee has purchased an existing location, are all sources of funds that need to be managed and considered when doing Cash Flow projections.

Uses for these funds are many; Staff has to be paid while they are training, often, before the business is even open.

Inventory may need to be purchased if it is a component of the business and was not included in the initial franchise opening package. Leasehold improvements, Furniture and equipment, uniforms….. the list seems endless.

Franchise accountants help a franchisee regularly review their debt structure to look for lower-cost options.

They also help determine the necessary cash flow to service the debt, as well as when to take on or eliminate certain debt to more efficiently utilize the tools for success that you have at your disposal.

Another aspect of a good franchise accounting firm is helping with managing employees and their training, motivation, schedule, wages, and tax requirements.

An accounting firm with business experience can often help an owner craft a compensation plan that will attract better employees, reduce turnover, increase job satisfaction, and best of all, increase productivity without increasing the cost of labor.

Franchisees are encouraged to use professional payroll services to help calculate wages and taxes for employees.

Most services will automatically file Monthly or Quarterly and Year-End employment tax documents and payments as part of their payroll service to keep franchisees in compliance with State and Federal law.

This, more than any other aspect of business ownership, is the least forgiving, most complex, and requires attention to detail, accuracy, and timeliness, as penalties can be severe, and both State and Federal agencies target this area to ensure business owners are filing and paying on-time.

Stick to a strict budget for your Franchise

Sticking to a budget is the best way to ensure good cash flow.

When owning a franchise, you must know the company’s recurring expenses, like franchise fees. There may be unexpected facility repairs, or an employees may occasionally work overtime, exponentially increasing payroll costs.

Knowing which of these expenses is predictable, and which will fluctuate with sales volume is important.

A franchise accountant can not only help you understand and thus control these things, but do a financial projection to anticipate future Cash Flow requirements to cover such events and avoid Working Capital shortfalls down the road (the number one reason businesses fail).

It is also helpful to have someone who is knowledgeable about the ins and outs of franchise fees, franchisor discounts, uncollected revenue write-offs and so forth from a tax perspective.

A franchise account will know what Gross Sales numbers need to be reported to the franchisor and the IRS for you to remain in compliance.

Remember, with a franchise business, the franchisor is like a not-so-silent partner. If they sense impropriety, they have the right to perform a full audit, even if it was just a mistake in bookkeeping.

The IRS is another story. Suffice to say that if it is a choice between paying to have your books kept correctly and not, you’ll be thrilled that you spent the money if you ever have to appear in front of the IRS.

Opening a franchise can offer many opportunities for a franchisee.

There is a strong brand already created, initial training and an Operations Manual to refer to for any and all possible situations, real estate and marketing assistance, and ongoing operational support.

With all of these benefits, it’s important to not forget the basis of any business; the books. Proper franchise accounting will help evaluate performance, address issues before they become problems, and develop solutions to ensure success.

Need help starting your franchise?

If you are looking for help with funding, consulting, or accounting services for your franchise, Volpe is here to help.

We specialize in Franchise Accounting, and we would be happy to discuss your needs and help you get started on the right foot.