Jump to a Specific Section

Breaking Down the Difference Between Tax and Legal Status

Starting and running a business involves navigating a variety of tax and legal structures. This guide will help you understand the different types of business tax filing statuses and legal entity statuses.

Legal Entity Statuses

Business legal status defines how the government legally recognizes a business. Each type has unique characteristics, advantages, and disadvantages.

Sole Proprietorship

- Description: The simplest form of business, owned and operated by one individual.

- Advantages: Easy to establish, complete control over business operations, straightforward tax filing.

- Disadvantages: Unlimited personal liability, limited ability to raise capital.

Partnership

- Description: A business owned by two or more individuals.

- Types: General Partnership (GP), Limited Partnership (LP), Limited Liability Partnership (LLP).

- Advantages: Easy to establish, shared resources and expertise.

- Disadvantages: Unlimited liability for GPs, the potential for conflicts, shared profits.

Limited Liability Company (LLC)

- Description: A flexible business structure that offers the liability protection of a corporation with the tax benefits of a partnership (we go over this in a bit more depth below).

- Advantages: Limited liability, flexible management structure, pass-through taxation (if elected).

- Disadvantages: More complex than sole proprietorships or partnerships, potential state-specific regulations and fees.

Corporation

- Description: A legal entity separate from its owners, providing limited liability protection.

- Types: C-Corporation (C-Corp) and S-Corporation (S-Corp).

- Advantages: Limited liability, ability to raise capital through stock, perpetual existence.

- Disadvantages: More regulatory requirements, potential double taxation for C-Corps.

Ultimately, the way you choose to structure your business will determine the amount of taxes you pay and the amount of personal risk to which you will be exposed.

Understanding Tax Filing Statuses

Your business tax filing status determines how a business reports its income and pays taxes to the IRS.

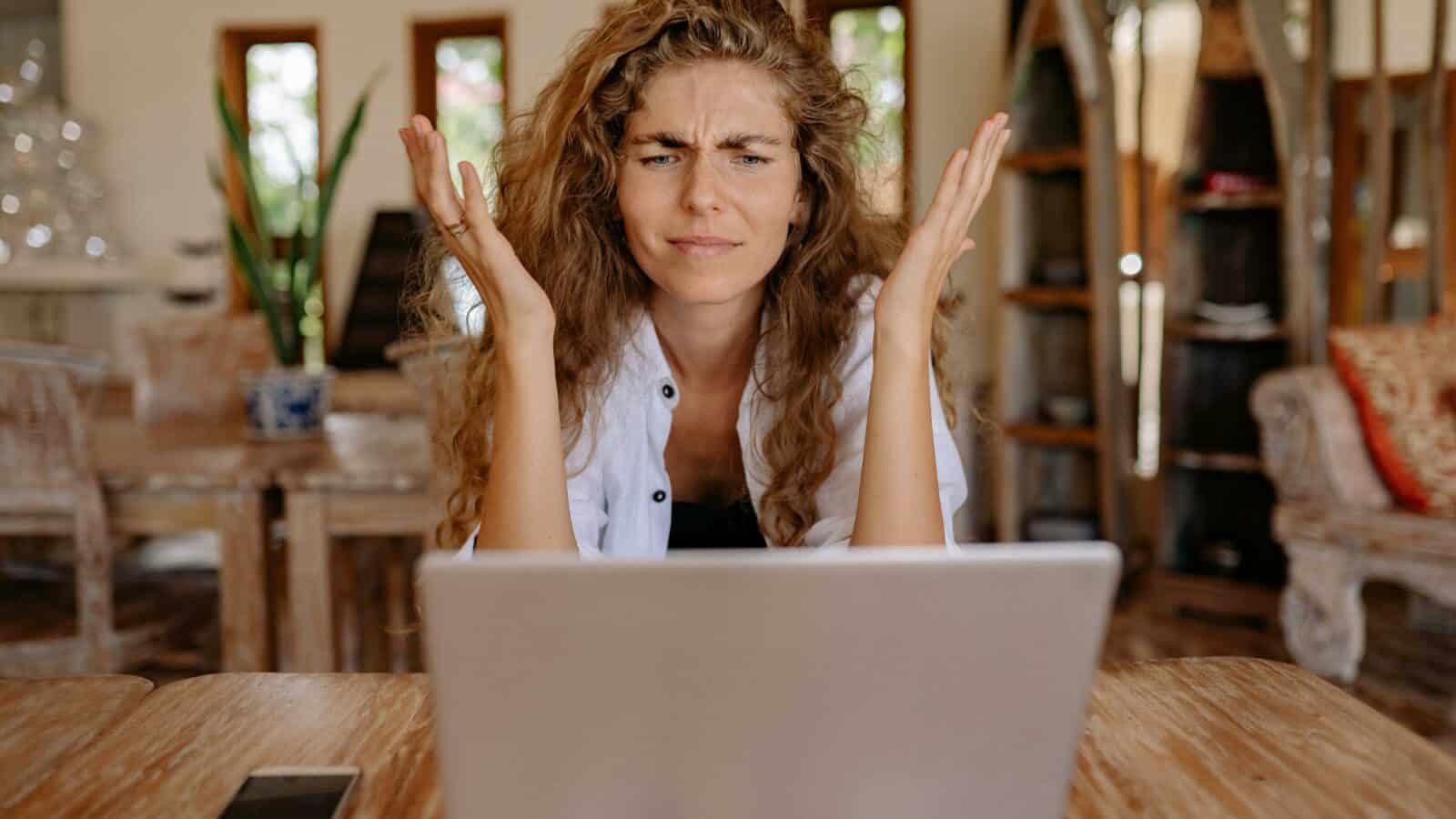

Schedule C (Form 1040)

- Used by: Sole proprietorships and single-member LLCs (unless another election is made).

- Description: Reports income and expenses directly on the owner’s personal tax return.

- Taxation: Business profits are taxed to the individual as personal income.

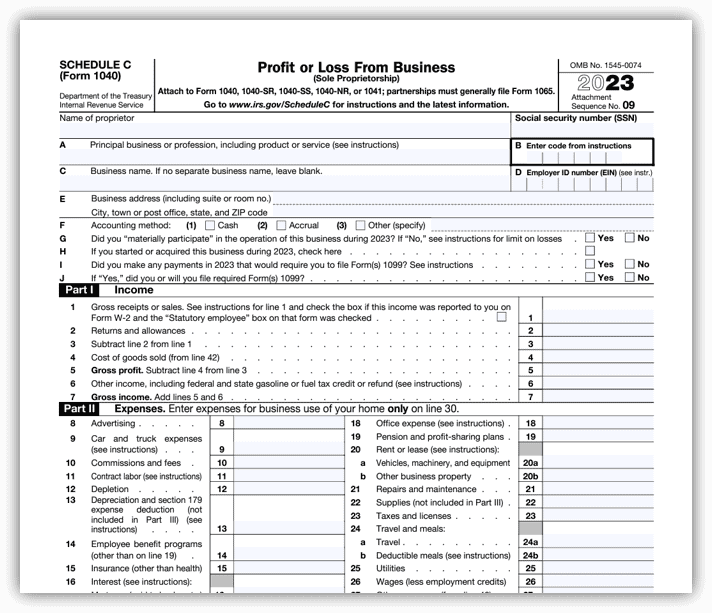

Form 1065 (U.S. Return of Partnership Income)

- Used by: Partnerships and multi-member LLCs (unless another election is made).

- Description: Reports income, deductions, gains, and losses from the partnership.

- Taxation: Pass-through taxation; profits are divided among partners and reported on their personal tax returns using Schedule K-1.

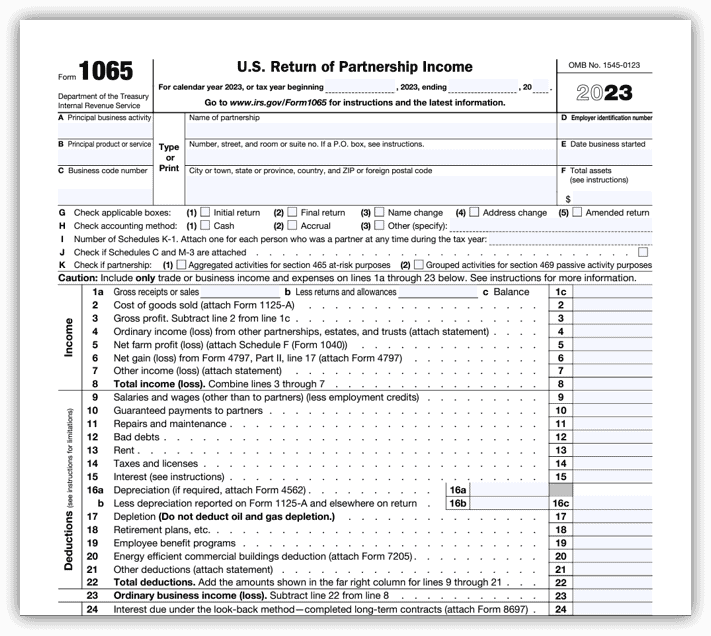

Form 1120 (U.S. Corporation Income Tax Return)

- Used by: C-Corporations.

- Description: Reports income, gains, losses, deductions, and credits of a corporation.

- Taxation: Corporate profits are first taxed at the corporate level; dividends distributed to shareholders are taxed again at the individual level, resulting in “double taxation.”

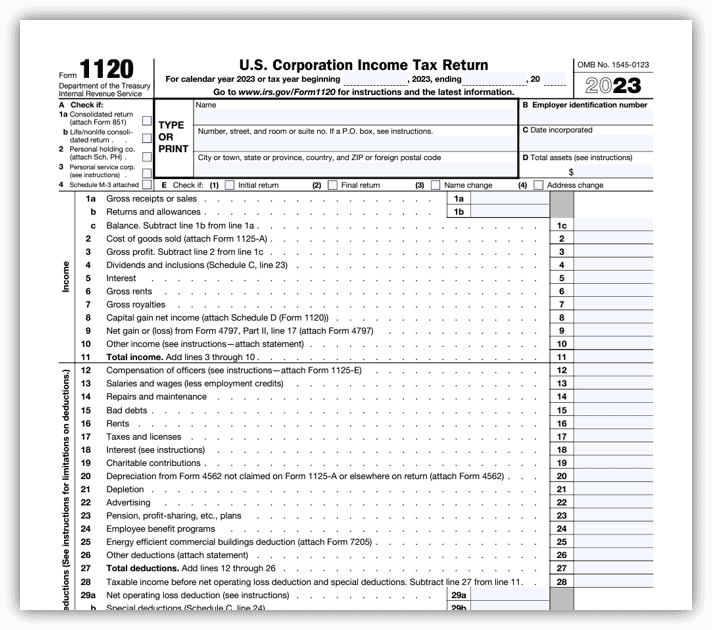

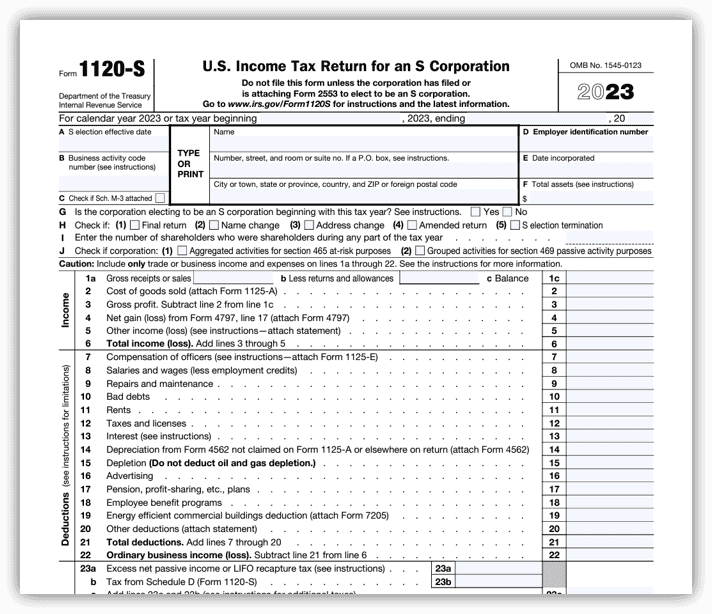

Form 1120-S (U.S. Income Tax Return for an S Corporation)

- Used by: S-Corporations.

- Description: Reports income, deductions, gains, and losses of an S-Corporation.

- Taxation: Pass-through taxation; business profits and losses are passed through to shareholders and reported on their personal tax returns using Schedule K-1.

S-Corporations vs. C-Corporations

S-corporations and C-corporations are two common business structures used in the United States. Understanding the difference between them can be extremely confusing but can significantly affect how your business pays taxes.

S-Corporations (S-Corps)

- Legal Status: Must be a domestic corporation that meets specific IRS requirements, including having no more than 100 shareholders and only one class of stock.

- Tax Filing Status: Uses Form 1120-S.

- Taxation: Pass-through taxation; avoids double taxation by passing business income directly to individual shareholders, who report it on their personal tax returns.

- Advantages: Avoids double taxation, provides limited liability, offers potential tax savings on self-employment taxes.

- Disadvantages: Stricter eligibility requirements, limits on the number and type of shareholders.

C-Corporations (C-Corps)

- Legal Status: A separate legal entity that can have an unlimited number of shareholders and multiple classes of stock.

- Tax Filing Status: Uses Form 1120.

- Taxation: Subject to double taxation; corporate income is taxed at the corporate level, and dividends distributed to shareholders are taxed again at the individual level.

- Advantages: Limited liability, easier to raise capital through stock, no restrictions on shareholders.

- Disadvantages: Double taxation, more regulatory requirements and formalities.

- LLCs and Tax Elections

Limited Liability Companies (LLCs)

- Legal Status: A flexible business structure offering limited liability protection.

- Tax Filing Status: Can elect to be taxed as a sole proprietorship, partnership, C-Corporation, or S-Corporation.

- Default Taxation:

- Single-member LLCs: Default to sole proprietorship (Schedule C).

- Multi-member LLCs: Default to partnership (Form 1065).

- Electing Other Tax Statuses:

- Advantages: Flexibility in taxation, limited liability, fewer formalities than corporations.

- Disadvantages: Can be more complex and costly to establish compared to sole proprietorships and partnerships, potential state-specific regulations.

Get Help from Accounting Experts

Understanding the distinctions between business legal entity statuses and tax filing statuses is crucial for making informed decisions about how to structure and run your business. Each type of business entity offers different advantages and disadvantages, and the choice can significantly impact your tax obligations and personal liability. By carefully considering these factors and consulting with a tax professional or business advisor, you can choose the structure that best aligns with your business goals and needs.