Jump to a Specific Section

Tax Savings with an S-Corp

Choosing the right business structure is crucial for any entrepreneur. If you’re a small-to-medium business owner, you may have heard about the S-Corporation (S-Corp) and wondered if it’s right for you. Let’s break down the benefits of an S-Corp, particularly focusing on tax savings.

What is an S-Corporation?

An S-Corporation is a special tax status granted by the IRS that allows a corporation’s income, deductions, and tax credits to pass through to its shareholders. This means that instead of the corporation paying taxes, the income is reported on the shareholders’ individual tax returns. This is a big departure from a C-Corporation, which faces double taxation—once on the corporate level and again on the individual level when profits are distributed as dividends.

LLC vs. S-Corp: Understanding the Difference

It’s important to note that merely organizing as an LLC is not the same as electing to file taxes as an S-Corp. An LLC, or Limited Liability Company, is a legal entity that provides liability protection to its owners, known as members. However, without making any special tax elections, an LLC’s default tax status depends on the number of members it has:

- Single-Member LLC: By default, a single-member LLC is treated as a disregarded entity, meaning it’s taxed like a sole proprietorship. The business’s income and expenses are reported on the owner’s personal tax return.

- Multi-Member LLC: By default, a multi-member LLC is treated as a partnership. The business files an informational partnership tax return, and income or losses pass through to the members, who report them on their personal tax returns.

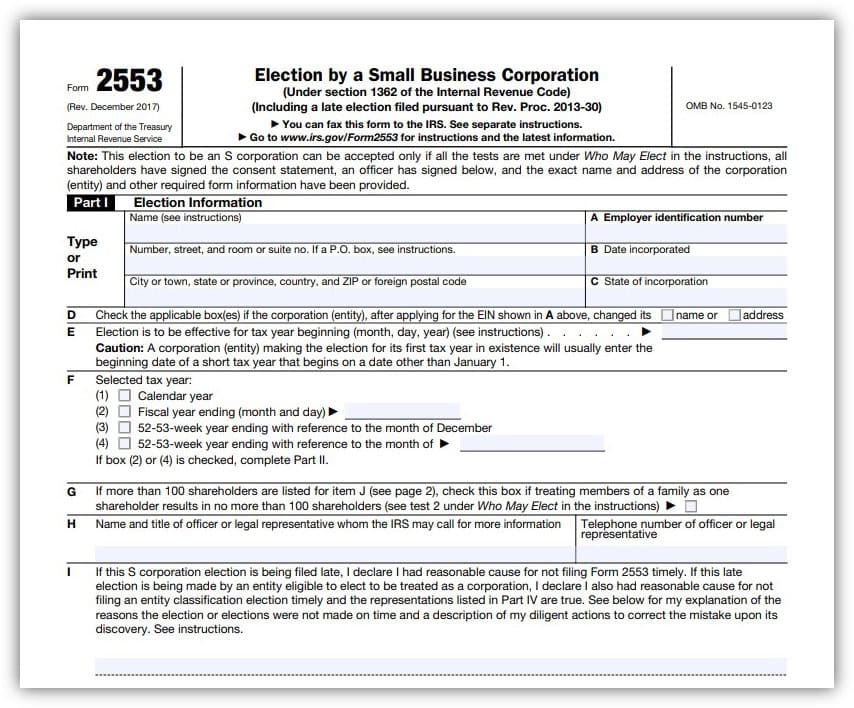

To take advantage of the tax benefits of an S-Corp, an LLC must file Form 2553 with the IRS to elect S-Corp status. This election changes how the LLC is taxed but does not alter its legal structure.

S-Corp Tax Savings and Benefits

The primary benefit of an S-Corp is the potential for significant tax savings, particularly by avoiding double taxation and minimizing self-employment taxes.

- Avoiding Double Taxation: In a C-Corporation, profits are taxed at the corporate level, and then again at the personal level when dividends are distributed to shareholders. An S-Corp bypasses this by allowing profits to be passed directly to shareholders, who then report these earnings on their individual tax returns, avoiding the double tax hit.

- Minimizing Self-Employment Taxes: Self-employment tax covers Social Security and Medicare taxes. For sole proprietors and partners, this tax can be significant—15.3% of net earnings. However, with an S-Corp, shareholders can be both employees and owners. They must receive a reasonable salary, which is subject to payroll taxes, but any additional income from the business can be distributed as dividends, which are not subject to self-employment tax. This can result in substantial savings.

Clarifying Self-Employment Taxes

For a single- or multi-member LLC that has not made the S-Corp election, each member still pays the full 15.3% self-employment tax on their proportion of the profits of the business, and then personal income tax on top of it. This means if your LLC earns a profit, you will have to pay both the employer and employee portions of Social Security and Medicare taxes on that profit.

In contrast, if the LLC elects S-Corp status:

- The business pays its half of the payroll taxes on the reasonable salaries paid to the shareholders/employees.

- The employees/shareholders pay their half of the payroll taxes on their salaries.

- The rest of the profits, distributed as dividends, are added to the shareholders’ taxable personal income but are not subject to self-employment tax.

At What Point Does S-Corp Status Make Sense?

Electing S-Corp status typically makes sense once your business reaches a certain size or revenue threshold. While there’s no hard and fast rule, many experts suggest that businesses with consistent profits of around $40,000 to $50,000 per year may start to see the benefits of S-Corp status. The savings on self-employment taxes can start to outweigh the costs and administrative requirements of maintaining an S-Corp.

Additional Benefits of Filing as an S-Corporation

- Liability Protection: Like a C-Corporation, an S-Corp provides liability protection. This means your personal assets are generally protected from business debts and claims, reducing your personal risk.

- Attracting Investment: While S-Corps have some restrictions on the number and type of shareholders, they can still attract investors who are interested in pass-through taxation benefits and liability protection.

- Simplicity in Ownership Changes: Transferring ownership in an S-Corp can be more straightforward than in other structures, which is advantageous if you plan to bring in new partners or sell the business.

Get Help from Tax Professionals

Choosing to elect S-Corporation status can offer substantial tax benefits and liability protection, making it an attractive option for many small-to-medium business owners. If your business is generating steady profits, it might be time to consult with a tax advisor or accountant to see if an S-Corp is the right move for you. The tax savings on self-employment and avoiding double taxation could significantly enhance your bottom line, allowing you to reinvest more into your business and achieve your financial goals more efficiently.

If you have any questions or need help with your company’s taxes, contact the accounting firm at Volpe for a free consultation.