Jump to a Specific Section

ROBS Rollover: Funding Your Business with Retirement Funds

Starting a business often requires significant capital, and one funding option you may not have considered is a ROBS rollover. ROBS stands for Rollovers as Business Startups. This method allows you to use your retirement funds to invest in your new business without incurring early withdrawal penalties or taxes. Let’s dive into what ROBS is, who qualifies, the process, and the pros and cons of using this method.

What is a ROBS Rollover?

ROBS allows you to roll over your existing retirement funds, like a 401(k) or IRA, into your new business. Essentially, you’re using your retirement savings to buy stock in your company, which then uses the funds to start or grow the business. This can be an attractive option for entrepreneurs who need capital but want to avoid loans or outside investors.

Eligibility for a ROBS Rollover

To qualify for a ROBS rollover, you must meet the following criteria:

- Retirement Plan Type: You need to have a qualifying retirement account, such as a 401(k) or traditional IRA.

- New C Corporation: The business you are funding must be structured as a C Corporation. This is a specific type of corporation recognized by the IRS.

- Active Role: You must be an active employee of the new business, meaning you must work for the business and receive a salary.

- Business Purpose: The business must be a legitimate, operating company, not just a passive investment.

Forms and Filing Requirements

The ROBS process involves several key steps and forms:

- Create a C Corporation: Form your business as a C Corporation with the appropriate state authorities.

- Establish a New Retirement Plan: Set up a new 401(k) plan within your C Corporation.

- Rollover Funds: Roll over funds from your existing retirement account into the new 401(k) plan (you do not have to roll over all the funds from your old retirement account, but you can).

- Purchase Stock: The new 401(k) plan uses the rollover funds to purchase stock in the C Corporation.

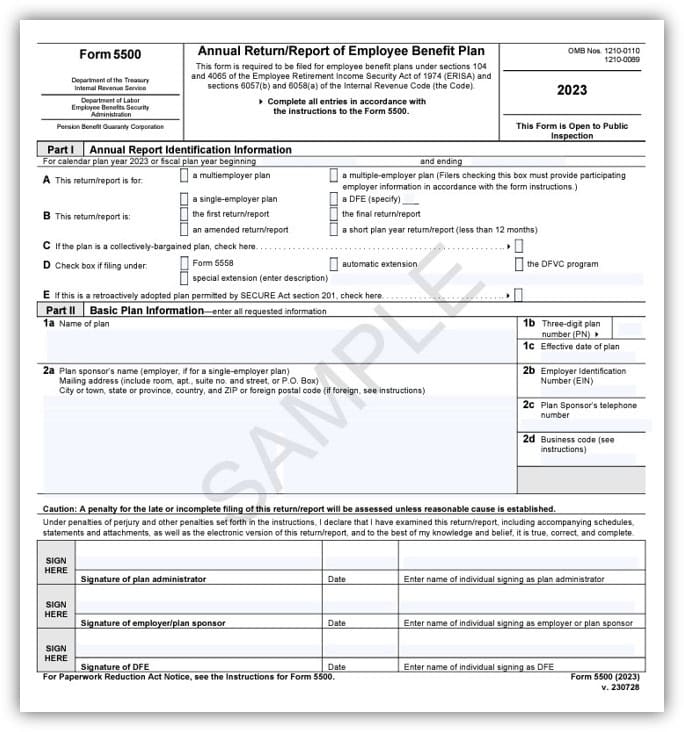

- Form 5500: Annually, you must file Form 5500 with the IRS, which reports the financial condition and operations of the employee benefit plan.

Rules for Using ROBS Money in the Business

Once you have rolled over your funds, there are specific rules on how you can use the money:

- Business Expenses: The funds can be used for various business expenses, including purchasing equipment, inventory, and real estate, or covering payroll and other operating expenses.

- No Personal Use: The funds cannot be used for personal expenses. Misuse of the funds can lead to severe penalties from the IRS.

- Salary to Owner: You can pay yourself a salary as you are required to be an employee of the business, but the salary must be reasonable.

Repayment to the Retirement Fund

One of the unique aspects of ROBS is that you do not need to repay the funds to your retirement account—neither the old one nor the new one. Instead, the funds are an investment in your business. The retirement account now holds stock in your company, so its value will depend on the success of the business.

What If Your Business Goes Bankrupt?

If your business fails, the retirement account value will decrease, reflecting the loss in the company’s stock value. You won’t owe money back to your retirement plan, but you will lose the funds that were invested in the business. It’s essential to understand that this risk is similar to investing retirement funds in the stock market—the value can go up or down based on the business’s success.

Pros and Cons of a ROBS Rollover

Pros of Using a ROBS Rollover

- No Debt: You can fund your business without taking on debt or giving up equity to outside investors.

- No Early Withdrawal Penalties: ROBS allows you to avoid the taxes and penalties usually associated with early withdrawals from retirement accounts.

- Business Ownership: You retain full ownership and control over your business. Your new 401(k) retirement plan technically owns a portion of your business (usually nearly all of the stock in the business), but you manage the retirement account, so you still effectively have control over the funds.

- Invest in Yourself: You’re investing in your future by using your retirement funds to build a potentially profitable business.

Cons of Using a ROBS Rollover

- Complexity and Costs: Setting up a ROBS is complex and often requires professional help, which can be costly. There are initial setup fees and ongoing administrative costs.

- Risk to Retirement Funds: If your business fails, you could lose a significant portion of your retirement savings. If you rolled over and invested the entire original fund, you could lose all of it.

- IRS Scrutiny: The IRS closely monitors ROBS arrangements, and any missteps can lead to severe penalties.

- C Corporation Requirement: You must structure your business as a C Corporation, which has tax implications and is not always the best fit for all business types.

- Double Taxation: Because your business must be structured as a C Corporation, the business is subject to corporate income tax on its profits, and then any dividends distributed to owners are subject to personal income tax, ultimately resulting in double taxation on the profits of the business.

- No Pass-Through Losses: Because a C Corporation is a separate income-taxable entity, any losses it incurs cannot pass through to its owners. Other business structures are considered “pass-through entities,” which means the profit or loss of the business flows through to the owner’s personal income, either increasing or decreasing the owner’s personal taxable income. C Corporations are not pass-through entities; therefore, the owner of a C Corporation cannot use business losses to reduce their own taxable income.

Should I Use a ROBS Rollover to Fund my Business?

A ROBS rollover can be a powerful tool for funding your business if you have substantial retirement savings and are willing to take on the associated risks. It allows you to invest in your business without incurring penalties or debt. However, due to the complexity and potential risks involved, it’s crucial to seek professional advice and thoroughly understand the process before proceeding.

With careful planning and execution, ROBS can provide the financial foundation needed to turn your business dreams into reality—without careful planning and execution, it can turn them into a nightmare.