Jump to a Specific Section

From Humble Beginnings to a Modern Tax Authority

The Internal Revenue Service (IRS) is one of the most significant and often misunderstood agencies in the United States. It has its roots in the earliest days of the nation, tracing back to a time when federal taxation was a new and somewhat controversial idea. In this blog post, we’ll explore the history of the IRS, including its precursor, the early ideas that led to its creation, its original plan, the types of taxes it was designed to collect, and how it has evolved and expanded over time.

“A government ought to contain in itself every power requisite to the full accomplishment of the objects committed to its care, and to the complete execution of the trusts for which it is responsible, free from every other control but a regard to the public good and to the sense of the people.”

– Alexander Hamilton, Federalist No. 31

The Precursor to the IRS: The Early Days of Federal Taxation

The idea of a centralized revenue authority in the United States dates back to the nation’s founding. However, the first significant effort to create an internal revenue system came during the American Civil War. Before that, the federal government was primarily funded through tariffs and excise taxes, which were indirect taxes on goods like whiskey, sugar, and tobacco.

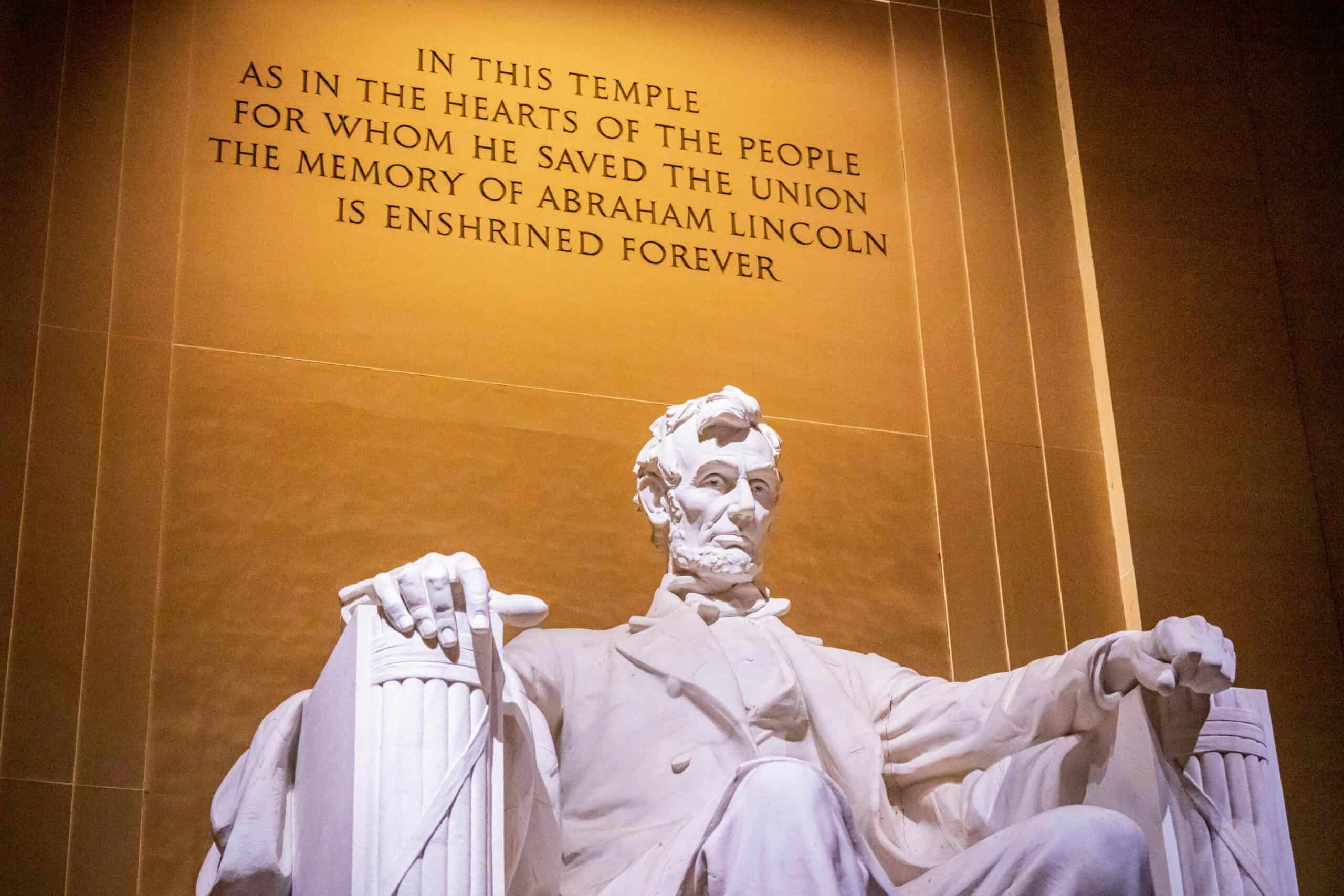

The precursor to the IRS was the Office of the Commissioner of Internal Revenue, established by Congress in 1862 to help fund the Union war effort. This office was the brainchild of Treasury Secretary Salmon P. Chase and President Abraham Lincoln, who realized that the war would require unprecedented levels of funding. The Revenue Act of 1862 introduced the first federal income tax and created a Commissioner of Internal Revenue to oversee the collection of these taxes.

The First Federal Income Tax and the Original Plan

The original plan for the Office of the Commissioner of Internal Revenue was straightforward: it would collect taxes on incomes exceeding $600 at a rate of 3% and 5% for incomes over $10,000. The Civil War income tax was a temporary measure, intended only to raise revenue during the conflict. It was highly controversial but ultimately successful in generating much-needed funds. By the end of the Civil War, the income tax had raised $347 million, a substantial sum at the time.

After the war, in 1872, the income tax was repealed. However, the debate over federal income taxation continued, as the country grew and federal responsibilities expanded.

The Early Evolution: From Repeal to Reinstatement

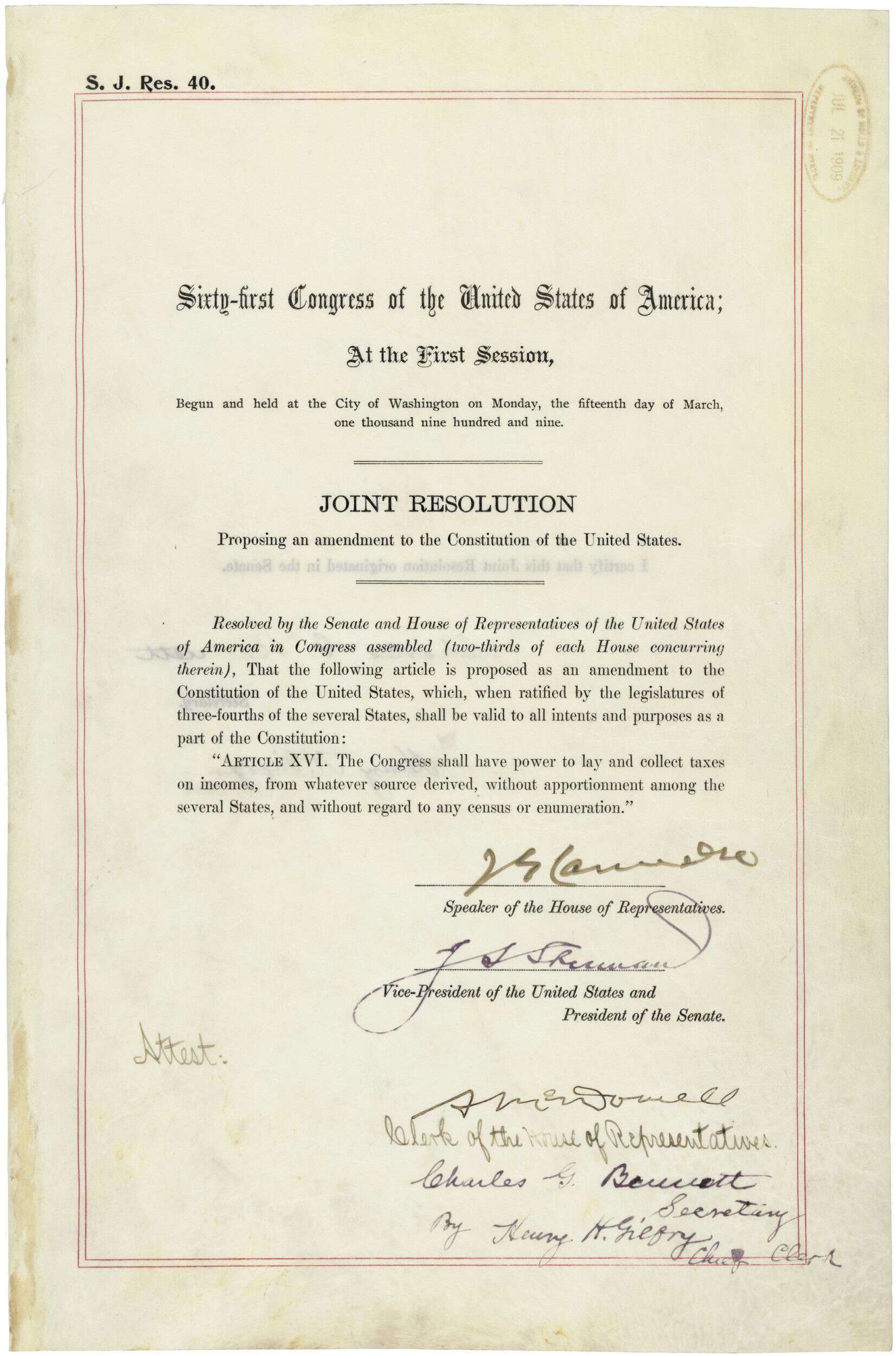

Although the Civil War-era income tax was short-lived, the need for federal revenue persisted, leading to a broader debate about the role of the federal government in taxation. In 1894, Congress revived the income tax by passing the Wilson-Gorman Tariff Act, which included a 2% tax on incomes over $4,000. However, the Supreme Court declared this tax unconstitutional in 1895, arguing that it was a direct tax that had to be apportioned among the states according to population.

The battle over the income tax continued until 1913, when the 16th Amendment to the U.S. Constitution was ratified. This amendment granted Congress the authority to levy a federal income tax without apportioning it among the states. Following the amendment’s ratification, Congress passed the Revenue Act of 1913, which officially established the federal income tax and led to the creation of a permanent Bureau of Internal Revenue.

The Bureau of Internal Revenue: Expansion and Implementation

The Bureau of Internal Revenue, the direct predecessor of today’s IRS, was charged with collecting the newly established federal income tax. At the time, the federal tax rate was set at 1% for incomes above $3,000 (about $85,000 today) and 6% for incomes over $500,000 (around $14 million today). The Bureau’s responsibilities were relatively modest in its early years, focusing mainly on income tax collection.

World War I marked the next significant expansion of the Bureau’s role. The Revenue Act of 1916 increased income tax rates and introduced the estate tax to help fund the war effort. By 1918, income tax rates had climbed to 77% for the highest earners, and the Bureau was collecting billions in revenue. The federal government’s reliance on income taxes continued to grow throughout the 1920s and 1930s, as new social programs and economic crises required additional funding.

Expansion of the Bureau’s Responsibilities

Over time, the Bureau of Internal Revenue’s responsibilities expanded beyond income taxes. The 1930s and 1940s saw the introduction of several new taxes:

- Social Security Tax (1935): Introduced as part of the Social Security Act to provide financial support for retirees and the disabled.

- Unemployment Insurance Tax (1939): Part of the Social Security Act, aimed at providing temporary financial assistance to unemployed workers.

- Excise Taxes (Various): Taxes on specific goods like gasoline, alcohol, tobacco, and luxury items, implemented throughout the 20th century to raise additional revenue.

The Bureau also began enforcing new tax laws related to corporate income, estate, and gift taxes. As the agency’s responsibilities grew, so did its bureaucracy. In 1953, the Bureau of Internal Revenue was officially renamed the Internal Revenue Service to reflect its expanding role and responsibilities.

The Modern IRS: Reforms, Challenges, and Growth

The IRS continued to evolve in the latter half of the 20th century. In the 1970s, the agency underwent a major reorganization to improve efficiency and modernize its operations. This period saw the introduction of computerized data processing, allowing the IRS to handle tax returns more quickly and accurately.

However, the growth of the IRS was not without controversy. The agency faced significant criticism in the 1980s and 1990s for perceived abuses of power, inefficiency, and a lack of transparency. In response, Congress passed the IRS Restructuring and Reform Act of 1998, which aimed to overhaul the agency’s structure and improve taxpayer rights.

Taxes Added to the IRS’s Collection Responsibilities

Since its inception, the IRS has been tasked with collecting various taxes that have been added to its portfolio over time:

- Income Taxes (1913): Federal taxes on personal and corporate income, were initially imposed to fund government operations and war efforts.

- Estate Taxes (1916): Taxes on the transfer of property after death.

- Gift Taxes (1924): Taxes on the transfer of property by gift.

- Payroll Taxes (1935): Taxes to fund Social Security and Medicare, collected from both employers and employees.

- Excise Taxes (Various): Targeted taxes on specific goods and services, such as alcohol, tobacco, gasoline, and firearms.

- Alternative Minimum Tax (1969): A tax designed to ensure that high-income individuals and corporations pay at least a minimum amount of tax.

The IRS Today: A Complex Agency

Today, the IRS is a large and complex agency responsible for administering the federal tax code, which consists of thousands of pages of laws and regulations. It collects over $4 trillion in taxes annually, representing nearly all the revenue that funds the federal government. The IRS processes more than 240 million tax returns and other forms annually, and it employs tens of thousands of workers in offices across the country.

The IRS’s functions have also expanded beyond just collecting taxes. It now handles a wide range of responsibilities, including:

- Enforcing tax laws: Ensuring compliance with federal tax laws through audits, investigations, and legal action.

- Administering tax credits: Overseeing programs like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), which provide financial assistance to low- and middle-income taxpayers.

- Providing taxpayer assistance: Offering resources and support to help taxpayers understand and meet their obligations.

The Future of the IRS: Modernization and Reform

The IRS continues to face numerous challenges, including the need for modernization and adapting to new tax laws. In recent years, Congress has pushed for further reforms, such as increasing funding for technology upgrades and improving taxpayer services. The agency is also focused on enhancing cybersecurity and protecting sensitive taxpayer data from increasing cyber threats.

Looking ahead, the IRS is likely to continue evolving as it navigates changes in the tax landscape, addresses new challenges, and strives to fulfill its mission of collecting revenue to fund the federal government.

Around for the Long Haul

From its humble beginnings as a temporary wartime measure, the IRS has grown into one of the most involved agencies in the United States government. Its evolution reflects the changing needs and priorities of the nation, as well as the challenges of administering a complex tax system in a rapidly changing world. As the IRS continues to modernize and adapt, it remains a cornerstone of the federal government’s efforts to serve the American people.

By understanding the history and evolution of the IRS, we gain insight into how this agency has shaped—and been shaped by—the broader currents of American history.

With any questions on the complexity of the current tax code, or to engage in extensive tax planning, contact us: