Jump to a Specific Section

What is Bookkeeping?

Bookkeeping serves as the foundation for all financial accounting processes in a business (especially full-service bookkeeping). An accountant or “bookkeeper” is responsible for recording and categorizing transactions such as purchases, expenses, and income you or your business makes. This enables you to maintain a clear and accurate picture of where your money is going and coming from. This is crucial for making informed financial decisions and ensuring your business’s financial health. Without accurate bookkeeping, you could find yourself facing financial discrepancies that can lead to bigger issues down the line.

Nowadays, there are tools such as Quickbooks services that allow much of the bookkeeping process to be automated. There are, however, still certain aspects of bookkeeping that require an accountant. Bookkeeping services performed by a local accounting firm will make sure your transactions are correctly categorized so you have a clear understanding of your cash flow. They also will be able to make sure you are writing off certain transactions as business expenses to minimize your tax responsibilities.

Bookkeepers handle a variety of tasks that go beyond simple data entry. They compile detailed financial reports, monitor cash flow, and ensure that you comply with tax regulations. By organizing your records and creating comprehensive statements, they help you gain insights into your financial performance, enabling you to identify trends and address any potential financial problems early on. Professional bookkeeping is not just about keeping records; it’s about maintaining a structured financial system that supports your business growth.

Keeping your books in order enables you to prepare for tax time with minimal stress. Accurate, well-organized records mean you can easily report your expenses and income, ensuring you claim all the deductions you’re entitled to while avoiding costly tax penalties. In essence, effective bookkeeping equips you with the financial clarity needed to run your business smoothly and achieve long-term success.

What Does “Full-Service Bookkeeping” Mean?

“Full-Service” is a relatively broad term, and its exact definition of when it comes to bookkeeping will ultimately depend on the accounting firm using it. Bookkeeping services can range from minimal involvement to complete management. Basic bookkeeping services, for instance, may mean an accountant reviews your Quickbooks account at the end of the year and files your taxes. Full-service bookkeeping, in most cases, means an accountant provides ongoing reviews of your transactions and is constantly monitoring your expenses, income, and cash flow to categorize them correctly.

Again, this is pretty dependent on the accounting firm you hire and their range of services. Ultimately, it is a more hands-on approach to bookkeeping that may be done each quarter, month, week, or even day.

Full-service bookkeeping goes beyond basic record keeping, offering a comprehensive suite of financial management services. This all-inclusive approach ensures that every financial aspect of your business is handled with precision and professionalism.

You can expect full-service bookkeepers to take care of daily transaction recording, ensuring that all your financial activities are accurately logged. They also manage bank reconciliations, which means your business accounts are consistently matched with your bank statements, providing a clear and accurate financial picture.

Managing accounts payable and receivable is another critical component. This involves tracking incoming and outgoing payments, helping you maintain healthy cash flow and avoiding any potential cash shortages. Payroll processing is also covered, ensuring your employees are paid correctly and on time, while adhering to relevant tax laws and regulations.

Additionally, full-service bookkeeping includes tax preparation and compliance. This means they not only prepare your taxes, but also ensure your business complies with all applicable tax requirements, reducing the risk of penalties. They provide valuable financial reporting, giving you insights into your business’s performance through detailed reports and financial statements.

But it doesn’t stop there. Full-service bookkeepers offer financial analysis, budgetary support, and strategic recommendations, helping you make informed decisions based on your financial data. By outsourcing these services, you gain access to expert advice and can focus more on growing your business while having peace of mind that your finances are in good hands.

What Does Full-Service Bookkeeping Include?

Full-service bookkeeping is designed to offer an all-encompassing solution for managing your business’s financial health. This means more than just tracking your income and expenses; it involves various crucial tasks that ensure your financial records are accurate and up-to-date. Here’s a breakdown of what full-service bookkeeping typically includes:

Ongoing Transaction Review and Categorization

Every financial transaction your business makes, from sales and purchases to expenses and bank deposits, is meticulously recorded. The frequency of which this happens may vary. This ensures that you always have a real-time view of your financial position.

Bank Reconciliation

Regular comparison of your business’s financial records against bank statements helps to identify discrepancies, ensuring accuracy and preventing fraud.

Accounts Payable/Receivable Management

Keeping track of what you owe to suppliers and what customers owe you is crucial. Full-service bookkeepers manage invoices, bills, and collections, helping you maintain positive cash flow.

Payroll Processing

Calculating and distributing payroll includes more than just cutting checks. Tax withholdings, employee benefits, and compliance with labor laws are all part of the process, ensuring your team gets paid correctly and on time.

Tax Preparation and Compliance

Full-service bookkeeping ensures all your financial records are prepared for tax season. This includes generating necessary financial reports and ensuring compliance with tax regulations to avoid penalties.

Financial Reporting

Generating regular financial reports like profit and loss statements, balance sheets, and cash flow statements gives you a clear picture of your business’s financial health.

What Are the Long-Term Benefits of Investing in Full-Service Bookkeeping?

Investing in full-service bookkeeping isn’t just about immediate returns; it provides a plethora of long-term benefits that can significantly enhance the overall health and growth of your business.

Cost-Effectiveness

While hiring a professional bookkeeper might seem like an added expense, it becomes a cost-effective option over time. Accurate financial records reduce the risk of costly mistakes, prevent fines from tax inaccuracies, and provide better financial management. This means you save substantial amounts in the long run.

Time-Saving Efficiency

Outsourcing bookkeeping tasks saves precious time that can be redirected toward more critical aspects of your business. Professional bookkeepers handle complex financial tasks with expertise, ensuring that your records are up to date without requiring you to spend hours on the details.

Financial Accuracy and Precision

Professional bookkeepers bring a high level of accuracy and precision to the table. Mistakes in bookkeeping can be costly and time-consuming to fix. With full-service bookkeeping, you can rest assured that your financial records are accurate, up to date, and compliant with all relevant laws and regulations.

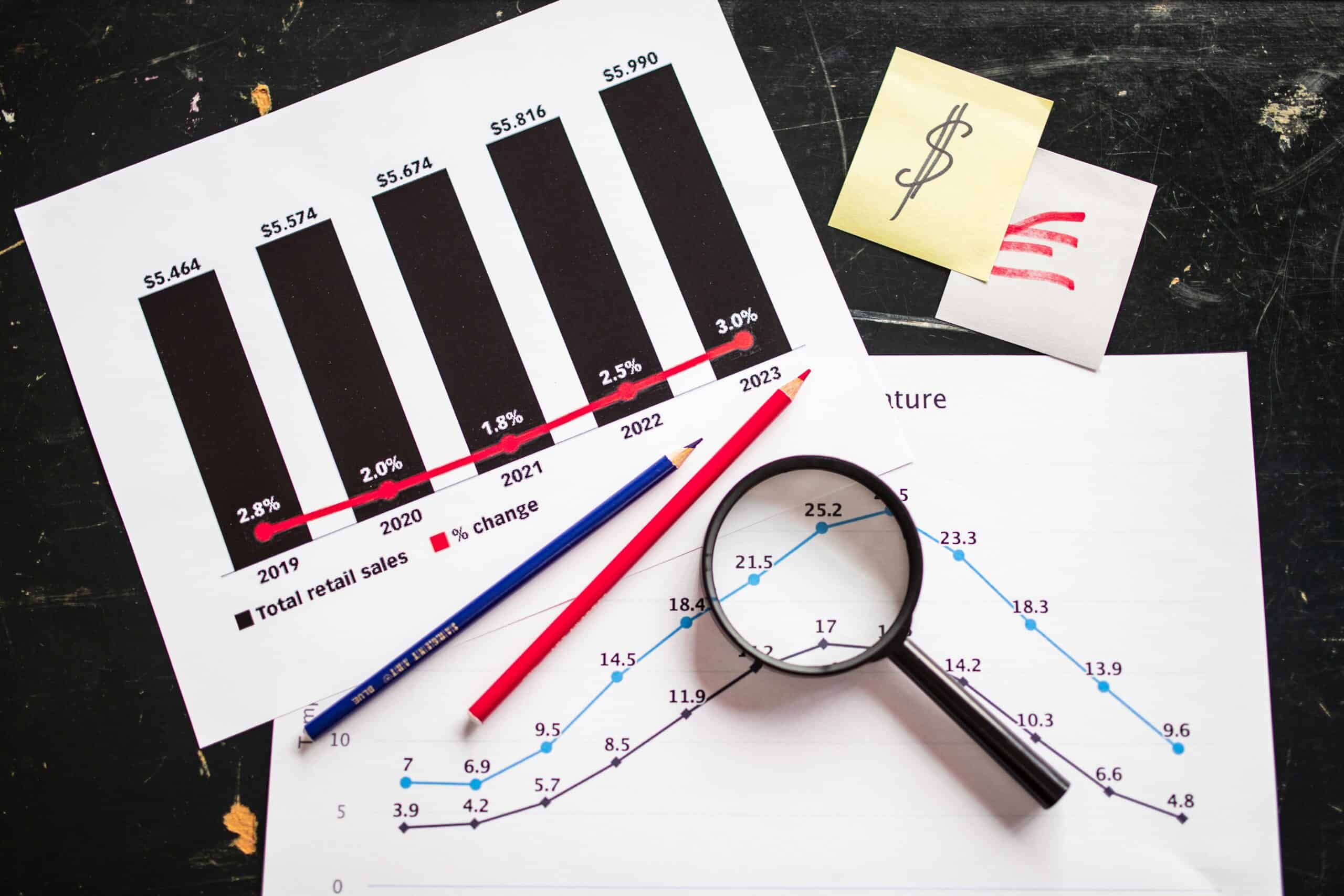

Strategic Financial Insights

Accurate and thorough financial reporting provides invaluable insights into your business’s financial health. These insights allow you to make informed strategic decisions, identify growth opportunities, and plan for the future effectively.

Stress Reduction

Managing finances can be stressful and overwhelming, especially during tax season. A full-service bookkeeping solution alleviates this stress by ensuring that all financial tasks are handled competently and efficiently. This peace of mind allows you to focus on running and growing your business.

Ultimately, full-service bookkeeping creates a solid financial foundation for your business, leading to sustainable growth and success in the long run.

You Need Full-Service Bookkeeping in Your Life

The obvious solution is to use a full bookkeeping service and actually use it consistently. Many small St. Louis business owners started their books with a shoe box full of receipts and (if they’re lucky) an Excel spreadsheet. To be honest, there is nothing wrong with keeping things simple when the business is a new start-up and its transaction count is considered relatively low.

But what happens when your business starts to take off, your revenue doubles in a year, and you are spending all kinds of money to either operate or promote your business on a daily basis? That’s great news, to be sure, but left unchecked, you might easily spend yourself out of business, or at least into serious debt before realizing it.

According to recent research by Shikhar Ghosh, a senior lecturer at Harvard Business School, about three-quarters of venture-backed firms in the U.S. don’t return investors’ capital; in other words, they fail. As many as 50% within the first year, and the rest within 5–7 years after that.

A typical start-up scenario can go like this: After 6 months to 2 years of spending all of the time learning the ropes of running the business and trying to keep things afloat, a business owner then realizes that he or she needs to go back to catch up their books, as they don’t accurately reflect the financial position of the business, and are useless. The owner was planning to spend a little time each day trying to do some updates—but it never happened. At this point, what should they do? Hire a bookkeeper, and through data entry on already inaccurate numbers, make things progressively worse, or go back to some starting point and start clean, doing it right?

An accurate bookkeeping service is not only a valuable tool to keep you informed regarding all the critical financial information in your business, but can also be considered a great investment that will provide an excellent return if it has been managed effectively. A good system started at the beginning, (or as soon as possible thereafter) provides a zero-entry platform where the business owner or bookkeeper doesn’t need to spend much time doing the books, and the results will tell you everything you need to know about your business.

One of the most fundamental things accurate records can do is show how much gross revenue is needed to be at the break-even point, and where all the money went, because after all, “Numbers Don’t Lie.”