Jump to a Specific Section

Payroll software recommended for small businesses by accountants in 2020

If you, like many small businesses in the United States, are looking for a way to manage your payroll, you have probably realized there are a lot of different software options on the market.

Payroll is a task no small business owner wants to deal with.

Doing it by hand has become pretty much non-existent, but it still is a time-consuming task that takes you away from your primary duties as a business owner.

A breakdown of the best payroll software to use in 2020

- Quickbooks payroll

- Gusto

- Freshbooks

- Rippling

- SurePayroll

- Zenefits

- Namely

- Ascentis

Do I need payroll software if I already have an accountant?

All things considered, payroll services are typically very affordable. Compared to bookkeeping and consulting, payroll services are rather inexpensive.

As a company that offers payroll services for small businesses, we typically advise that we are – in some way – involved with our client’s payroll.

When we are familiar with all of our client’s finances and have an understanding of what their payroll expenses are, it makes it easier to provide financial advice and also makes their quarterly and annual bookkeeping and returns much easier.

With that said, we still advise our clients to use some form of payroll software.

Whether it is just for inputting data or a complete payroll solution that employees use to clock in and out when our client uses software we can automate with another platform like Quickbooks or Qvinci, if it makes our jobs much easier.

Additionally, when you use payroll software, it makes it easier for you to budget expenses and get an understanding of the hours your employees are working.

What should I look for in my payroll software?

This is a question we get asked a lot and is typically dependent on your business.

Some questions we typically ask include:

- Do you need your payroll software to offer time-tracking/clocking in and out?

- Do you want to have the ability to file your quarterly or year-end forms?

- Do you need it to have a simple or in-depth interface/user experience design?

- How much are you willing to spend on your payroll software?

What payroll software do accountants think is the best?

1. Quickbooks Payroll

Source: Quickbooks

Best for: Small businesses looking for a popular payroll software solution or one already using Quickbooks Online or Desktop

Nowadays, Quickbooks has become pretty much the industry norm and has essentially monopolized the accounting industry.

Just about every accounting firm offers Quickbooks accounting services – or at least has a strong understanding of how it works.

Because of this, when you use Quickbooks to manage your small business’s payroll, it makes it easy for your accountant to integrate into their process.

We recommend trying Quickbooks Online software before you sign up for payroll, because if you are not a fan of their primary services, it may be a waste of time and money to use their payroll software.

How much does Quickbooks Payroll software cost?

- Self Service Payroll is $35/mo ($17.50 for the first three months) + $4/employee per month

- Full-Service Payroll is $80/mo ($40 for the first three months) + $4/employee per month*

Quickbooks Payroll Software Features:

- Direct deposit (available 24/7)

- File your forms at the end of the year directly through Quickbooks

- Calculate paychecks

- W-2s are filed and then sent to you*

Where can I use Quickbooks Payroll software?

- Online via browser

- Mobile app

- Desktop application

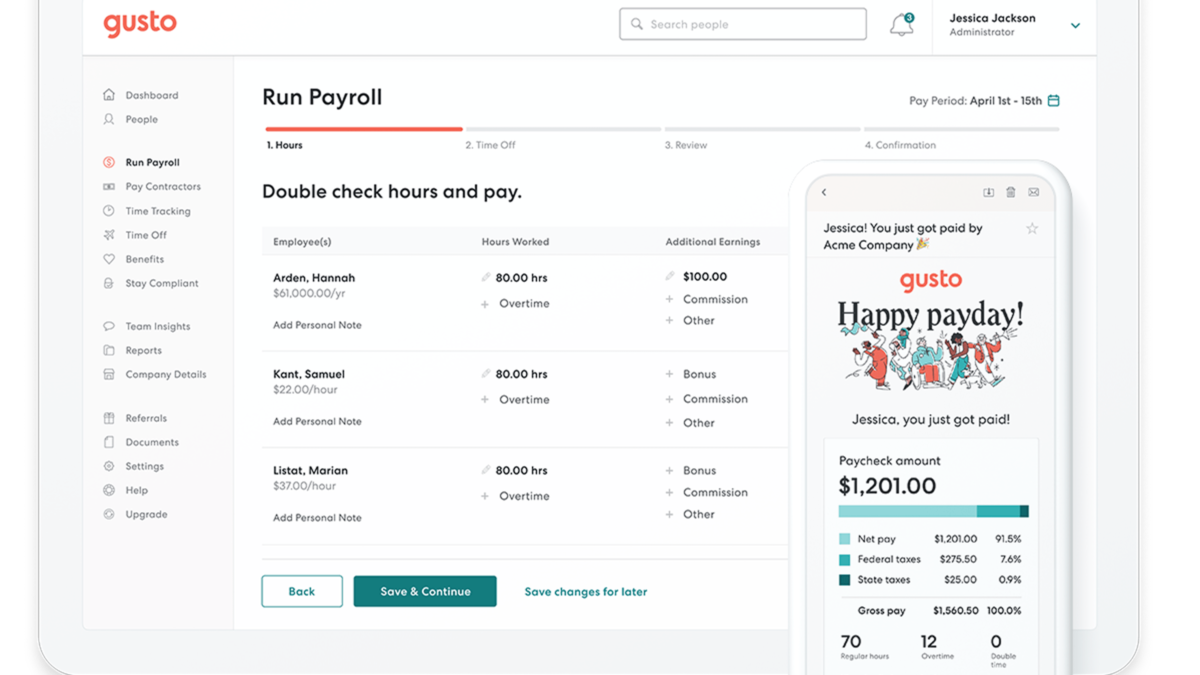

2. Gusto Payroll Software

Source: Gusto

Best for: Small businesses looking for a Quickbooks alternative with a beautiful interface

Gusto has become increasingly popular in recent years.

The most common reason we hear from clients as to why they are using Gusto to manage their payroll is because they were not happy with Quickbooks.

While Quickbooks offers an entire sweet of accounting and financial tools, Gusto is built specifically for Payroll.

Gusto also has a very popular time tracking tool that makes it easy to manage things like employee hours, time off, and PTO policies.

Gusto is also a very team-oriented payroll solution where Quickbooks is primarily for business owners.

You can use Gusto for things like company surveys, employee onboarding, securely storing and sharing documents, and many other crucial human resource tasks.

Gusto is not built exclusively for the small business owner. Gusto allows accountants to access and management to make things much easier on both you and your accountant.

How much does Gusto software cost?

Gusto offers a 1 month free trial to small businesses looking to test out their payroll software. After that, the pricing is as follows:

- Core is $39/mo + $6/employee per month

- Complete is $39/mo + $12/employee per month*

- Concierge is $149/mo + $12/employee per month**

Gusto Payroll Software Features:

- Quickbooks integration

- Complete, full-service payroll

- Employee profiles and self-service ability

- PTO (paid time off)/vacation policies

- Time tracking on phone or desktop *

- Admin can set permissions to individual employees *

- Employee onboarding and special offers *

- A directory of your employees *

- Employee surveys *

- W-2s are filed and then sent to you*

- Assigned a certified human resource professional **

Where can I use Gusto Payroll software?

- Online via browser

- Mobile app

- Desktop application

Related: The Best Invoicing Software for Small Businesses in 2020

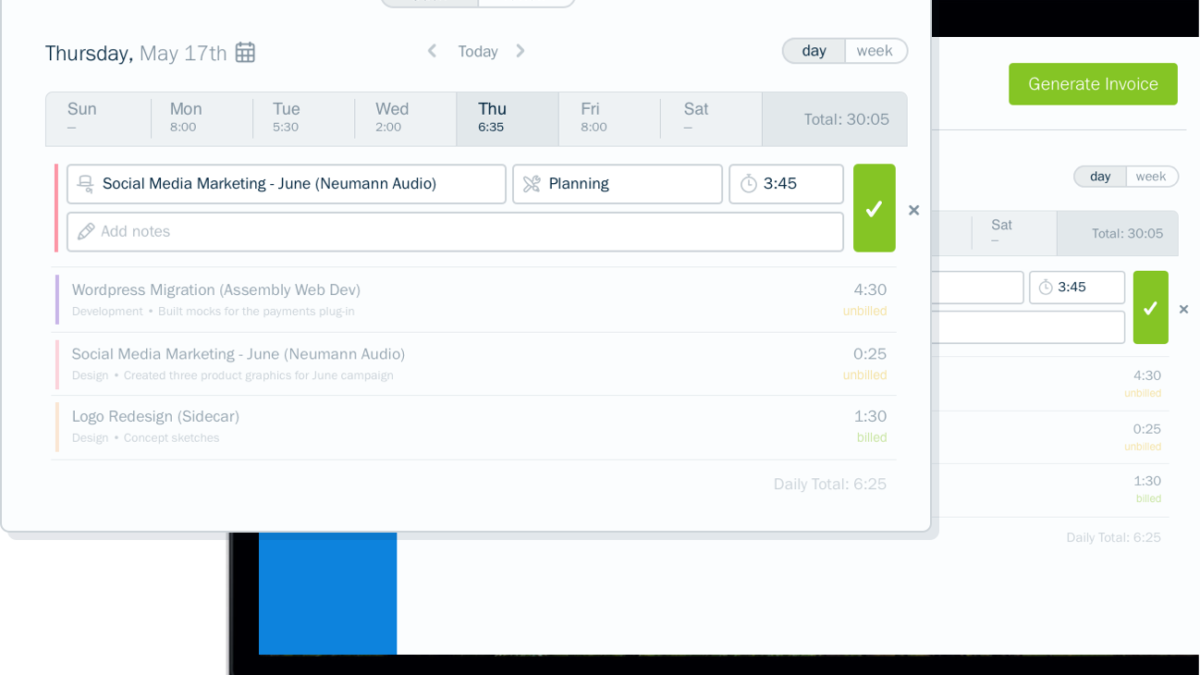

3. Freshbooks

Source: Freshbooks

Best for: Small businesses or individuals who need to track time and bill clients based on time spent on their project

Freshbooks is another modern payroll solution built with a large suite of accounting and financial tools.

Of all the options on this list, Freshbooks is definitely the best option for startups, freelancers, and individuals who may hire freelancers or part-time employees.

Along with a great payroll tool, Freshbooks also is also great for project collaboration and invoicing.

Not only can you track your employee hours, but you can also track your own hours for billing clients.

Freshbooks allows you to create projects (or customers). You and/or and employee can then track time for individual projects or customers.

You can then send those hours directly to your client.

Your client can also pay you directly through Freshbooks.

One of our favorite features is the employee/company calendar.

It allows you to get a bird’s-eye view of when your employees are working and on which project they will be working.

How much does Freshbooks software cost?

Freshbooks offers a month free trial to small businesses looking to test out their payroll software. After that, the pricing is as follows:

- Lite is $15/mo + $10/employee per month (5 clients max)

- Complete is $25/mo + $10/employee per month (50 clients max) *

- Premium is $50/mo + $10/employee per month (500 clients max)**

Gusto Payroll Software Features:

- Quickbooks integration

- Unlimited custom invoices

- Expense tracking

- Accept credit card and bank transfer payments

- Automatic bank syncing

- Time tracking

- Client retainers *

- Late payment reminders *

Where can I use Gusto Payroll software?

- Online via browser

- Mobile app

- Desktop application

Others to make our list of payroll tools

- 4. Rippling – A modern payroll tool for paying employees, contractors and freelancers

- 5. SurePayroll – If you use Paychex, SurePayroll may be for you as it is part of the Paychex family

- 6. Zenefits – Zenefits has the best interface of all the payroll software on this list and is a great tool for human resource departments

- 7. Namely – Namely is another tool aimed at making things easier on human resource departments with a suite of payroll, time tracking, and onboarding tools

- 8. Ascentis – Once again, great for human resource departments, time tracking, and payroll

Need help organizing your payroll and choosing software?

We are a small business accounting firm in St. Louis, but we work with businesses all across the United States.

We are always helping new and existing clients manage their company’s payroll, and we would love to consult with you.

Whether you need a full-service payroll company to manage your time tracking and payroll or simply just need help getting started, you can contact us and we would be happy to help.

Need payroll for your franchise?

Volpe Accounting specializes in accounting for franchises and can help you get started on the right foot.