Executive Summary

In recent years, artificial intelligence (AI) has evolved from a futuristic concept into a practical tool reshaping the way we work, communicate, and make decisions. It’s no longer confined to science fiction or high-tech labs; it’s integrated into our emails, search engines, smartphones, and business software. With each advancement, it raises new possibilities—and new questions.

Perhaps the most common question in today’s professional landscape is, “Will AI take my job?” This concern is shared across industries, from manufacturing to marketing to legal services. And accounting is no exception. Even in a field built on rules, precision, and structure, professionals are beginning to ask: Can machines do what we do? And if they can, what does that mean for the future of our profession?

Accounting has always adapted to technological changes. From paper ledgers to Excel spreadsheets, from desktop software to cloud-based platforms—the field has evolved alongside the tools it uses. But AI represents a different kind of change. It’s not just a faster calculator or a more efficient spreadsheet. It’s a system that can analyze massive datasets, interpret natural language, recognize patterns, and even offer strategic recommendations. That level of automation and intelligence introduces both significant opportunities and legitimate concerns.

Some see AI as a game-changing asset that can help firms work faster, smarter, and more profitably. Others worry that relying too heavily on AI could erode the profession’s human element—especially in areas that demand judgment, ethics, and contextual understanding. There’s also unease about what AI means for job security, career development, and regulatory compliance in a field where accuracy is everything.

This article explores the pros and cons of using artificial intelligence in accounting. From automation and analytics to privacy concerns and professional responsibility, we’ll look at both sides of the conversation to help you understand not just what AI can do, but what it should do—and how to find the right balance between technology and human expertise.

What Is AI?

Before we examine its applications, it’s important to define what we mean by artificial intelligence. Artificial Intelligence (AI) refers to the ability of machines to perform tasks that typically require human intelligence—such as pattern recognition, language comprehension, decision-making, and problem-solving.

AI entered the mainstream around 2015 with the rise of OpenAI, but it gained global recognition in 2022 with the release of ChatGPT. While the concept of AI might seem new to some, it actually traces back to the mid-20th century. Alan Turing, a foundational figure in computer science, famously proposed the Turing Test—a way to assess a machine’s ability to exhibit intelligent behavior equivalent to or indistinguishable from that of a human. In 2014, a program named Eugene Goostman passed this test, marking a notable milestone.

AI consists of several specialized fields, including:

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Deep Learning

- Neural Networks

- Speech Recognition

To function effectively, AI models are trained using vast amounts of data—referred to as “training data”—which helps the system recognize patterns and make predictions or decisions. Over time, with user feedback and real-world interactions, the system becomes increasingly refined and autonomous. Once it reaches a certain level of proficiency, it can be rolled out for consumer or enterprise use.

Now that we’ve outlined what AI is and how it works, let’s explore the pros and cons of AI in accounting.

Pros

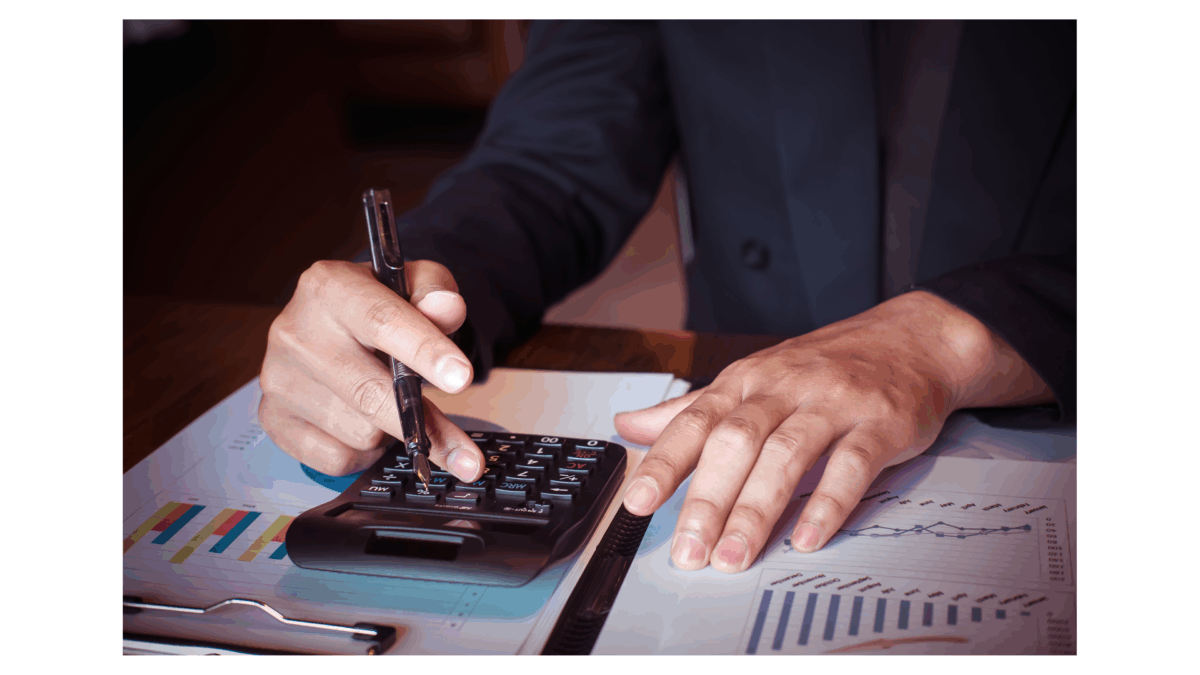

- Automating Repetitive Tasks

AI excels at automating routine and repetitive accounting tasks, such as data entry, invoice processing, and reconciliation. While traditional tools like Excel macros or VBA scripts have helped in the past, AI goes further by recognizing patterns you may not yet be aware of and building automation workflows without the need for manual coding. This saves time and reduces human error.

- Faster Analysis

With Natural Language Processing (NLP), AI can quickly scan, understand, and summarize large volumes of financial documents. Accounting firms can use it to generate meeting summaries, analyze emails, or digest legal tax documents in a fraction of the time it would take a human. Additionally, AI systems can run variance analyses across massive datasets, flagging discrepancies that might indicate fraud or data entry mistakes.

- Real-Time Reporting and Forecasting

AI tools enable real-time financial dashboards and forecasting models that provide up-to-the-minute insights into a business’s financial performance. Instead of relying on monthly or quarterly reports, organizations can use AI to make immediate, informed decisions based on live financial data.

- Enhanced Accuracy and Error Reduction

Manual accounting is vulnerable to errors, especially during data entry or spreadsheet calculations. AI systems reduce these errors by automatically validating and cross-checking entries, significantly increasing overall data accuracy and reducing the need for constant rework or audits.

- Improved Client Service

AI allows accountants to deliver faster and more personalized services to their clients. Tools like chatbots or automated reporting can respond to client inquiries instantly, generate real-time financial updates, and even make personalized recommendations—freeing up accountants to focus on strategic advisory roles.

- Cost Savings Over Time

Though there may be an upfront cost to implementing AI tools, over time these systems can reduce labor costs, streamline operations, and improve productivity. This results in long-term cost savings and allows firms to allocate resources more efficiently.

Cons

- Still in Early Development

Despite the hype, AI technology is still maturing. Many tools are prone to errors, misinterpretations, or hallucinated data—especially when dealing with complex legal or financial scenarios. For example, AI may cite outdated or non-existent regulations, requiring continuous human oversight to ensure accuracy and reliability.

- Adapting to Changing Laws and Regulations

Tax codes and financial regulations are constantly changing—and vary greatly across jurisdictions. While AI can assist in processing this information, it still requires manual verification. There’s a real risk that AI may miss or misinterpret important updates, which could lead to compliance issues or legal exposure if left unchecked.

- Lack of Human Intuition

AI systems follow rules and logic—but they lack contextual understanding and human judgment. For example, if a business owner mixes personal and business expenses, an AI system may mis-categorize personal vacation meals as business deductions. Human accountants bring critical thinking and professional skepticism to such scenarios, which machines currently can’t replicate.

- Overreliance and Reduced Learning for New Accountants

There’s concern that newer accountants could become too dependent on AI tools, bypassing the essential learning curve of digging into financial statements and tax codes. AI may provide the correct answer, but not the reasoning behind it—depriving users of deeper understanding. The risk is a generation of professionals who know how to use the tools, but not how to think like accountants.

- Data Privacy and Security Risks

AI relies on large datasets, many of which include sensitive personal or financial information. If not handled properly, these systems pose a risk of data breaches, unauthorized access, or regulatory non-compliance. Firms must ensure that any AI solution used adheres to stringent data protection standards.

- High Implementation and Maintenance Costs

Implementing AI solutions often requires a significant upfront investment, along with staff training, system integration, and ongoing support. For small to mid-sized firms, these costs may outweigh the short-term benefits. Additionally, keeping AI systems updated to meet changing regulations and business needs requires continuous effort and budget allocation.

Conclusion

The rise of artificial intelligence is undeniably reshaping the accounting landscape. Tasks that once took hours can now be completed in minutes. Massive data sets can be analyzed in real time. Reports can be generated with a few clicks. These advancements create incredible opportunities for growth, efficiency, and innovation within the profession.

However, AI is not a magic bullet. It cannot replace critical thinking, professional judgment, or ethical responsibility. It doesn’t understand context the way humans do, and it still struggles with nuance, ambiguity, and ever-evolving tax laws. For these reasons, human oversight remains not just valuable—but essential.

More importantly, the future of accounting will not be defined by AI alone, but by how we choose to use it. Accountants who embrace technology while maintaining their analytical skills and ethical judgment will be the ones who thrive. AI should be seen as a powerful tool to enhance the human element, not eliminate it.

In the end, AI won’t take your job—but someone using AI might.

If there’s a pain point within your operation that you’d like to discuss, we’re here. We’d appreciate the opportunity to look into it with you and hopefully provide some insight as to how you can move forward. For more information, or to just put a few faces to the name,

Disclaimer: The content on this blog is for informational, educational, and occasional entertainment purposes only. It should not be construed as legal, tax, or financial advice.