Jump to a Specific Section

Understanding 401(k) ROBS Rollovers BEFORE Using Retirement Funds to Start a Business

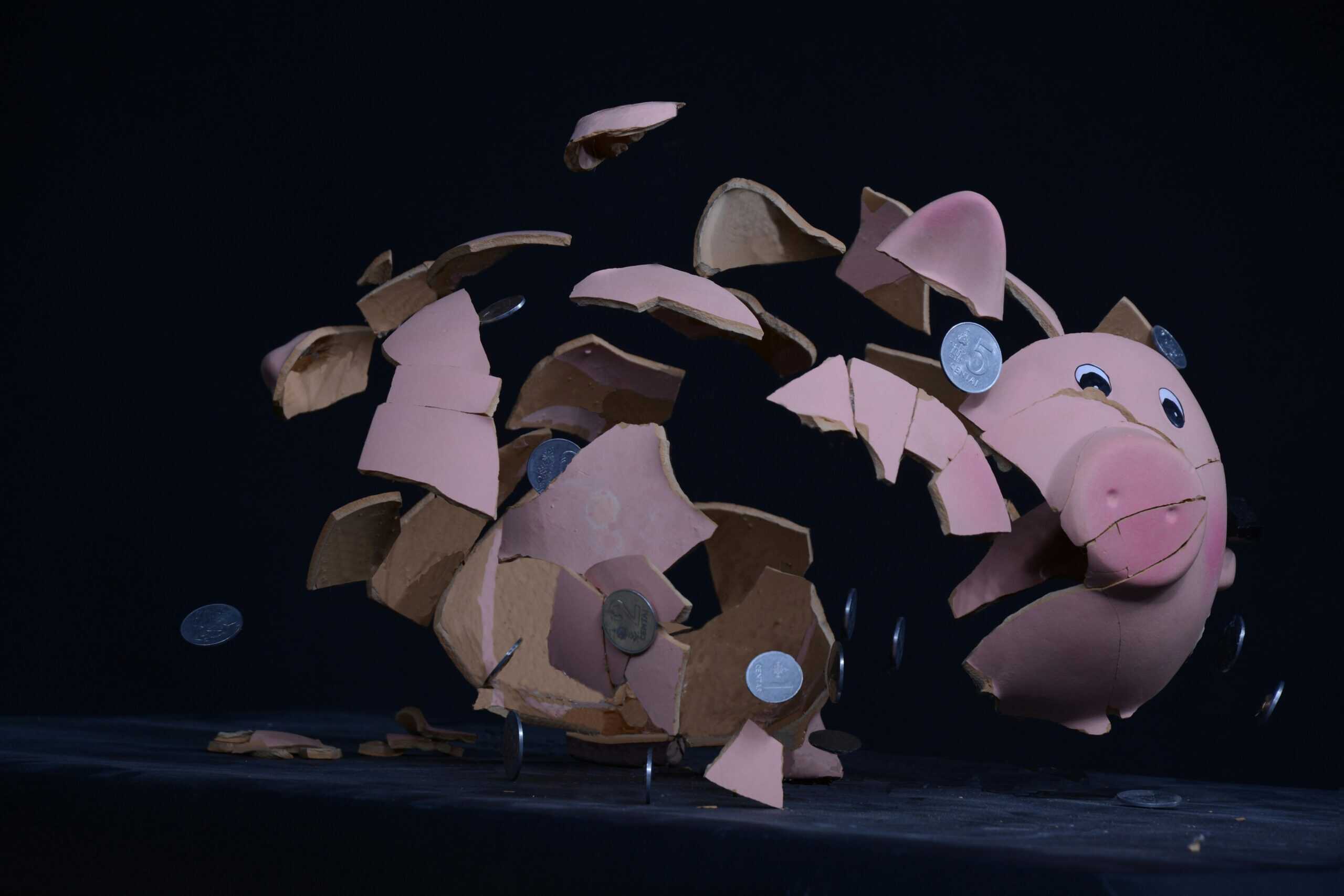

Starting a business often requires significant capital, and one innovative way to fund your venture is through a 401(k) Rollover as Business Start-up (ROBS). This method allows you to use your retirement savings to finance your business without incurring early withdrawal penalties or taxes.

In a nutshell, you take your 401(k) retirement savings and invest it all into your business.

In this article, we’ll explore how a 401(k) ROBS rollover works, its benefits and downsides, and how to exit the process smoothly.

How a 401(k) ROBS Rollover Works

A ROBS arrangement involves several steps to ensure compliance with IRS regulations and to properly fund your business:

- Establish a C Corporation: The first step is to set up your business as a C Corporation. This structure is necessary because it allows the corporation to issue stock, which is a key component of the ROBS process.

- Create a New Retirement Plan: The C Corporation must establish a new qualified retirement plan, typically a 401(k). This plan will be used to roll over your existing retirement funds.

- Roll Over Retirement Funds: You then roll over funds from your existing 401(k) or IRA into the new 401(k) plan established by the C Corporation. This rollover is done without triggering taxes or penalties.

- Purchase Company Stock: The new 401(k) plan uses the rolled-over funds to purchase stock in the C Corporation. This effectively converts your retirement savings into business capital.

- Use the Funds for Business Expenses: The C Corporation can now use the proceeds from the stock sale to fund business operations, such as purchasing equipment, leasing space, or covering other start-up costs.

Pros and Cons of a 401(k) ROBS Rollover

Using a ROBS arrangement to fund your business offers some advantages, but the downsides are real:

1) Tax and Penalty-Free Access to Funds:

PRO: One of the most significant benefits is that you can access your retirement funds without incurring early withdrawal penalties or taxes. This can provide a substantial amount of capital for your business.

CON: If your 401(k) is performing well, the profitability of your business likely won’t outperform it. You may instead be able to borrow the necessary start-up funds at a lower net cost from a bank or other financial institution.

This would eliminate the cost to administer and maintain the fund, give you the flexibility of structuring the business as an LLC or S-Corp—which comes with substantial tax advantages in most cases—and eliminates the possibility of putting your retirement savings at significant risk.

2) Debt-Free Financing:

PRO: Unlike traditional loans, ROBS financing does not require you to take on debt or make monthly loan payments. This can reduce start-up financial strain and improve cash flow during the critical early stages of your business.

CON: There are significant initial setup costs and ongoing administrative fees associated with maintaining the ROBS structure, not to mention the start-up costs of the business itself. These costs can add up and impact the overall financial benefit of using your retirement savings to fund your business idea.

3) No Credit Requirements:

PRO: ROBS financing does not depend on your credit score, making it an accessible option for individuals who may not qualify for traditional business loans. *In this author’s opinion, this is the one and only reason to resort to a ROBS to fund a business venture if all other potential sources have been exhausted.

CON: The majority shareholder in the C-Corp you formed to administer the funds and own the business is the ROBS, not you.

The nature of a C-corp means that any money you decide to take out in addition to your salary will have to be declared as dividends, and dividends have to be paid out in proportion to the ownership structure of the business. Because the ROBS owns the majority of the business, the majority of the dividends must go to the ROBS, not you.

Additionally, due to the inefficient structure of C-Corps, any profit-taking beyond your salary will be taxed twice.

4) Invest in Yourself:

PRO: By using your retirement funds to start a business, you get the serotonin boost of investing in your own venture rather than the stock market. This can be particularly appealing if you have confidence in your business idea and prefer to have direct control over your investment.

CON: Funds in use will not grow over time because they have been removed from the stock market. As you have taken them out of the retirement investment to invest in your own business, only the profitability of your business will increase your retirement funds.

5) Potential for Higher Returns:

PRO: If you have a killer, unbeatable business plan, and your business is successful, the returns on your investment could be significantly higher than traditional retirement investments. This can potentially help grow your retirement savings more effectively.

CON: If your business is not successful, you run the risk of depleting a substantial portion of your retirement savings, if not all of it.

Most importantly, if your business is not profitable and you want to put what’s left of the ROBS fund back into a regular retirement account, unwinding the ROBS in order to re-establish your retirement account and restore the funds is incredibly complex, and can be very costly.

Summary – Opinion of the Author

When considering all of the factors present in utilizing a ROBS Rollover to fund a business, there are not many situations in which the ROBS option is the better choice. Consider these costs, which are rarely factored into the equation:

- Cost of initiating the ROBS and setup fees.

- Monthly ongoing maintenance fees.

- Loss of 401(k) retirement fund growth on monies used in financing the business.

- Corporate tax on profits, plus Individual income tax on the same profits when taken as Dividends (double taxation).

- ROBS is the majority owner of the C-corp.

- Inability to utilize savings created by S-corp election, which can easily exceed five figure savings annually.

- Very difficult, time consuming, and expensive to exit (in order to move to an S-corp or more tax-advantaged structure).

How to Exit a 401(k) ROBS Rollover

Exiting a ROBS arrangement involves several steps to ensure compliance and avoid penalties:

- Repurchase Stock: One common exit strategy is for the C-corp to repurchase the stock held by the 401(k) plan. This involves buying back the shares from the retirement plan, increasing the relative ownership of anyone else with outstanding shares (e.g., you), and effectively removing the ROBS structure. However, the total stock value—and therefore the buyback amount—may be significantly higher than the amount that was initially invested by the 401(k) plan. Before repurchasing the stock, a Business Valuation will have to be performed by an accredited expert.

- Terminate the Retirement Plan: If you decide to close the business or no longer need the ROBS structure, you will need to terminate the retirement plan. This involves adopting a board resolution to terminate the plan, notifying plan participants, and ensuring the plan is compliant with all amendments before termination.

- File Required Forms: You may need to file specific forms with the IRS, such as Form 5310, to request a determination letter for the termination of the plan. Additionally, you will need to file a final Form 5500 to report the plan’s termination.

- Consult Professionals: Given the complexity of exiting a ROBS arrangement, it is advisable to consult with your ROBS provider, an attorney, and an accountant to ensure all steps are completed correctly and to avoid potential penalties.

- Consider Other Financial Avenues: If you are exiting the ROBS structure because you no longer need the funds for your business, consider other financial avenues for your retirement savings. This could include rolling the funds into a traditional IRA or another qualified retirement plan.

Not for the Risk-Averse

A 401(k) ROBS rollover can be a viable last resort for funding your business, offering benefits such as tax- and penalty-free access to funds, debt-free financing, and the potential for higher returns—if your business can print money. However, it also comes with massive risks, including the potential total loss of retirement savings, complexity, and compliance requirements.

By understanding the ROBS process and taking steps to exit smoothly, you can make informed decisions that support both your business and your retirement goals.

If you have any questions or need further assistance with weighing the risks of a 401(k) ROBS rollover, consider consulting with a financial advisor who can provide personalized guidance based on your unique situation.