Jump to a Specific Section

eCommerce: Doing Business Online

Starting an eCommerce business is an exciting venture filled with opportunities to reach a global audience and achieve financial independence. However, managing finances and taxes can quickly become overwhelming. Implementing effective accounting and tax-saving strategies is crucial for sustaining your business’s growth and profitability.

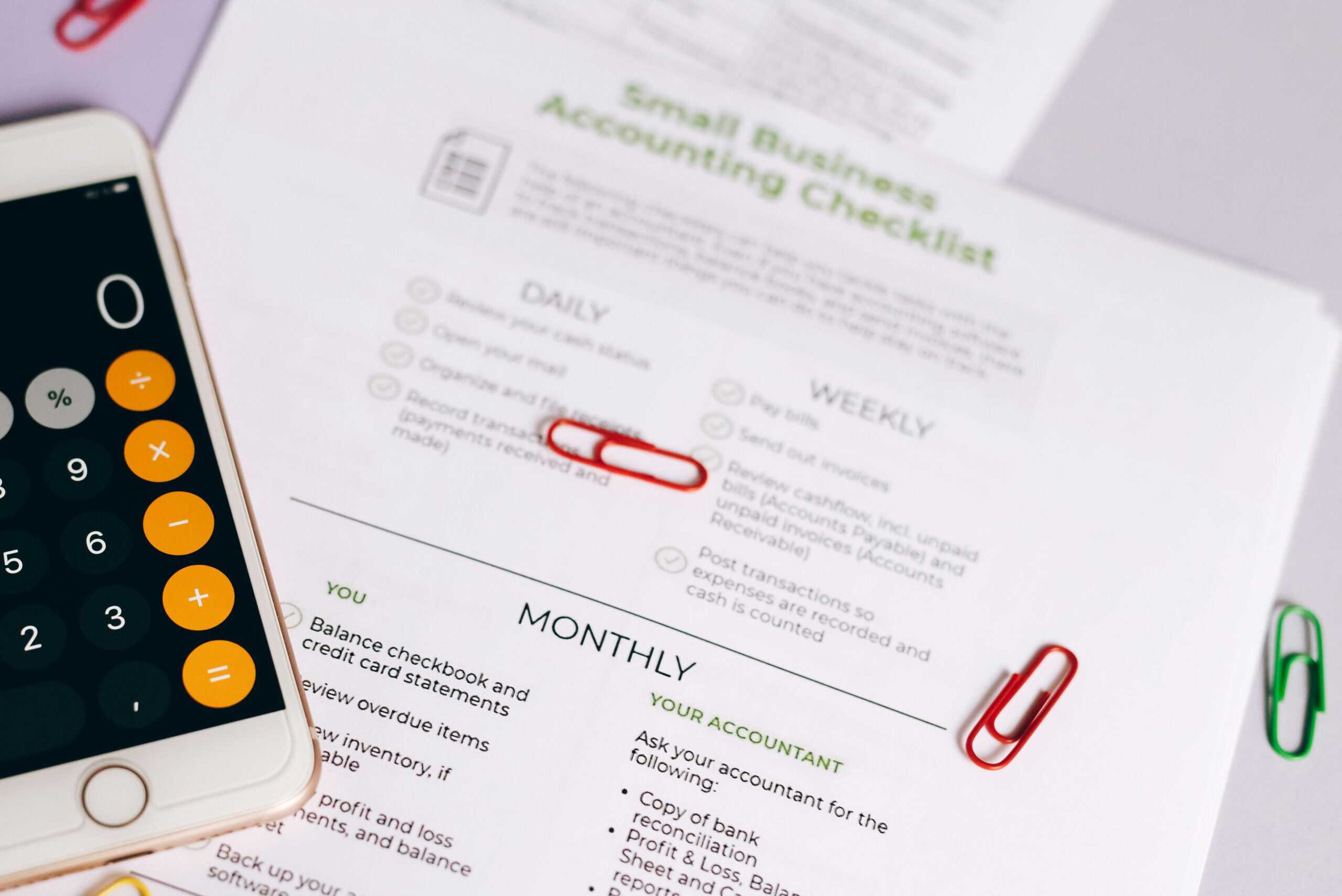

One of the first steps you should take is to set up a reliable accounting system. This system will be the backbone of your business’s financial health, helping you track income, expenses, and profits. Many eCommerce platforms like Shopify, WooCommerce, and Amazon offer integrated accounting tools, but you might also consider dedicated accounting software such as QuickBooks or Xero.

Here at Volpe, we provide eCommerce accounting services to businesses located in St. Louis, Missouri, and around the United States. If you have questions, please do not hesitate to use the contact form.

Tax Responsibilities of eCommerce Companies

Understanding your tax responsibilities is fundamental to maintaining the financial health of your eCommerce business. It’s not just about keeping the IRS happy—it’s about ensuring your business can thrive without unexpected financial setbacks. Here are the most common tax responsibilities you’ll need to manage:

1. Sales Tax

One of the most critical aspects of eCommerce taxation is sales tax. Depending on where you’re selling your products, you may be required to collect and remit sales tax. This can be particularly tricky for online businesses that sell across multiple states or countries. Each state in the U.S. has its own sales tax laws and rates, so you’ll need to be diligent about understanding these requirements.

2. Income Tax

Your eCommerce business will also be liable for income tax. This encompasses federal income tax, state income tax, and possibly local income taxes depending on where your business is situated. Income tax is typically calculated on the net income of your business, which is essentially your total revenue minus allowable deductions and expenses. Staying organized with your bookkeeping and keeping track of all your expenses will help you ensure that you’re accurately reporting your income and minimizing your tax liability.

3. Self-Employment Tax

If you’re operating your eCommerce business as a sole proprietorship or partnership, you are also responsible for self-employment tax. This tax covers Social Security and Medicare contributions, which are typically handled through payroll in traditional employment but need to be managed independently when you’re self-employed. In 2024, the self-employment tax rate stands at 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

4. Estimated Taxes

Many eCommerce entrepreneurs need to make estimated tax payments throughout the year, especially if they expect to owe $1,000 or more in taxes when their return is filed. These quarterly payments help spread the tax burden across the year and avoid potential penalties for underpayment. The IRS provides schedules and guidelines for calculating and paying estimated taxes to help you meet these obligations smoothly.

5. International Sales Tax

If you sell internationally, understanding the intricacies of international tax laws is crucial. Different countries have varying VAT (Value Added Tax) or GST (Goods and Services Tax) regulations that you must comply with. Each country may have its own rules regarding the threshold for sales tax registration. For example, in the European Union, businesses must register for VAT if their sales surpass a certain threshold.

Understanding Sales Tax for eCommerce Online Sales

Sales tax laws can vary significantly from state to state. This means taxes in the State of Missouri are different from those in Nebraska. This means that as an eCommerce business owner, you need to understand where your business has nexus—a legal term that indicates a connection or presence in a state, requiring you to collect and remit sales tax there. Nexus can be established in various ways, such as having a physical location, employing workers, or even selling a certain amount of products in that state.

States with the highest sales tax

According to the Tax Foundation, the 5 states with the highest combined state and local sales tax in the United States in 2024 are:

- Louisiana: 9.56%

- Tennessee 9.55%

- Arkansas: 9.45%

- Washington 9.38%

- Alabama 9.29%

California’s 7.25% sales tax rate is the highest at the state level in the United States.

States with the lowest sales tax

The Tax Foundation found that 5 states with the lowest combined state and local sales tax in the United States in 2024 are:

- Alaska: 1.82%

- Hawaii: 4.50%

- Wyoming: 5.44%

- Maine: 5.50%

- Wisconsin: 5.70%

Once you’ve identified the states where you need to collect sales tax, the next step is to register for a sales tax permit in those states. Without this permit, collecting sales tax is both illegal and risky, exposing your business to potential fines and penalties.

Using accounting software or hiring Quickbooks accounting specialists can be a game-changer for managing your sales tax obligations. These software solutions are designed to help eCommerce businesses accurately calculate sales taxes for each transaction, taking into account the varying rates and rules across different jurisdictions. This greatly reduces the margin for error and helps ensure compliance, giving you peace of mind.

Tax Collection for eCommerce Platforms like Etsy and Amazon Sellers

Two of the most popular online sales platforms today are Etsy and Amazon. The good news is that most of the largest online marketplaces now calculate, remit, and refund sales taxes automatically thanks to the Marketplace Facilitator Legislation. The Marketplace Facilitator Legislation is a set of laws that require online marketplaces to automatically remit sales taxes if the seller exceeds a certain threshold.

These laws vary by state but can be crucial to saving your eCommerce business time and money if you operate in a state with these laws. The specifics of these laws can be confusing and complex, and we recommend you contact us with any questions. Here are some additional resources regarding guidance for state-specific Marketplace Facilitators: